Loading

Get Ma Nhr 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA NHR online

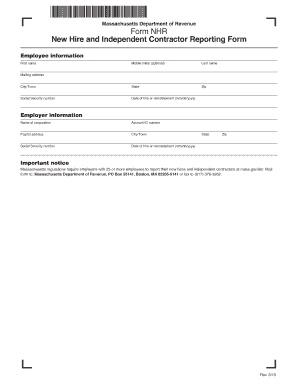

The Massachusetts New Hire and Independent Contractor Reporting Form (MA NHR) is essential for employers to report new hires and independent contractors. This guide provides step-by-step instructions to ensure accurate completion of the form online.

Follow the steps to complete the MA NHR form online.

- Press the ‘Get Form’ button to access the MA NHR form and open it in your editor.

- Enter the employee's information starting with their first name and middle initial (if applicable), followed by their last name.

- Provide the city or town where the employee resides, along with the state and zip code.

- Input the employee's Social Security number to ensure proper identification.

- Fill in the 'Date of hire or reinstatement' using the format mm/dd/yyyy.

- Provide the mailing address of the employee.

- Next, enter the employer's information including the name of the corporation.

- Input the employer’s account ID number for tracking purposes.

- Fill in the payroll address, along with the corresponding city or town.

- Include the employer's Social Security number and date of hire or reinstatement for the employee.

- Complete the fields concerning the state and zip code for the employer.

- After all sections are filled out, review for accuracy before proceeding.

- Once completed, you can save the changes, download the form, print it, or share it as needed.

Take action today by completing the MA NHR form online.

To complete the Massachusetts employee's withholding exemption certificate, begin by providing your personal information, such as your name, address, and Social Security number. Next, follow the instructions on the form to indicate any exemptions you qualify for. This document is important for determining the correct amount of tax withholding in line with MA NHR guidelines, making it vital for your financial planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.