Loading

Get Mn Lg200a 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN LG200A online

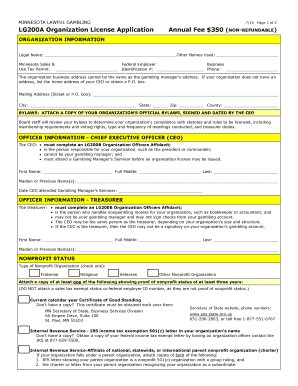

The MN LG200A is an essential document for organizations seeking to conduct lawful gambling in Minnesota. This guide provides a step-by-step overview to assist you in accurately completing the form online, ensuring compliance with all necessary requirements.

Follow the steps to complete the MN LG200A Organization License Application online.

- Press the ‘Get Form’ button to access the MN LG200A form and open it in your web browser.

- Fill in your organization's legal name and any other names used. Ensure this information is complete and accurate.

- Provide the Minnesota Sales & Use Tax Permit and Federal Employer Identification Number, along with a phone number where you can be reached.

- Input the mailing address for your organization, which should not be the same as the gambling manager’s address. If applicable, use the home address of your chief executive officer (CEO) or a P.O. box.

- Attach a copy of your organization’s bylaws, ensuring they are signed and dated by the CEO.

- Complete the officer information sections for both the CEO and treasurer, including their names and previous names, as well as the date they attended the Gambling Manager’s Seminar for the CEO.

- Indicate the type of nonprofit organization by checking the appropriate box, and attach proof of nonprofit status, such as a Certificate of Good Standing or IRS income tax exemption letter.

- Specify the timings of regular meetings and indicate voting rights eligibility by selecting 'yes' or 'no.' Provide a membership list of at least 15 active voting members signed by the CEO if voting rights are limited.

- Acknowledge your responsibility by reading and confirming the declarations, followed by the CEO’s signature and date. Make sure the CEO signs their name, as a designee cannot sign.

- Review all information for accuracy, then save, download, or print the completed form before submission.

Complete your documents online now to ensure your organization is fully prepared for lawful gambling activities.

Related links form

Minnesota state legislature allows for 18+ patrons in the state's card rooms, and there are plenty of rooms that follow this minimum age. Running Aces & Racetrack, Grand Mille Lacs, and Canterbury Park are some of the notable 18+ poker rooms in the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.