Get Ny Deferred Compensation Plan Change Form 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY Deferred Compensation Plan Change Form online

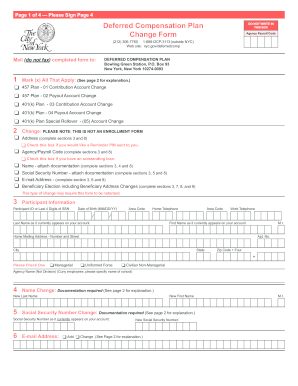

This guide provides comprehensive instructions on completing the NY Deferred Compensation Plan Change Form online. Follow these steps to ensure that you accurately fill out the form and submit the necessary changes to your account.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the NY Deferred Compensation Plan Change Form and open it in your browser.

- Review the form and identify the sections that apply to your changes. Mark the appropriate options in the designated checkboxes, such as Contribution Account Change or Payout Account Change.

- Fill in your participant information in Section 3. Include your Last Name, First Name, Date of Birth, Social Security Number, and contact details. Ensure that this information matches what is on your account.

- If you are requesting a name or Social Security Number change, provide the required documentation as specified in Sections 4 and 5. Make sure to attach any relevant proof of these changes.

- Complete Section 6 with your email address to opt for electronic communication regarding your account. This will facilitate receiving documents and notifications directly to your inbox.

- In Section 7, you will designate your beneficiaries. Carefully specify each beneficiary's name, their relationship to you, and the percentage they will receive in the event of your death. Ensure the total percentage adds up to 100%.

- After filling in all relevant information, review the entire form for accuracy. Check for any errors or missing sections that need completion.

- Finally, sign and date the form in Section 8. If you are changing beneficiaries, have the form notarized according to Section 9 instructions. Ensure the notary date matches your signature date.

- Submit the completed form by mailing it to the address provided on the form. Do not fax it. Confirm that you have included any necessary attachments before sending.

Complete your changes today and manage your deferred compensation plan online.

Get form

Negatives of a deferred compensation plan include potential tax implications, as taxes are due when you withdraw funds, possibly at a higher rate than when earned. Additionally, these plans can make it challenging to access funds for emergencies, which might not suit everyone’s financial strategy. It's also essential to evaluate the stability of your employer, as your benefits depend on their financial health. Completion of a NY Deferred Compensation Plan Change Form could be necessary should you reevaluate your strategy.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.