Loading

Get Il Ptax-230 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL PTAX-230 online

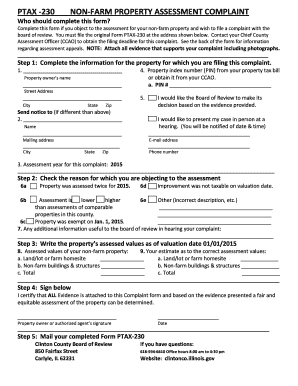

This guide provides a clear, step-by-step approach to completing the IL PTAX-230 form for non-farm property assessment complaints. By following these instructions, users can effectively submit their objections to property assessments with confidence.

Follow the steps to complete the IL PTAX-230 online.

- Press the ‘Get Form’ button to access and open the IL PTAX-230 online form.

- Fill in the information regarding the property for which you are filing the complaint. Provide the property owner’s name, property index number (PIN) from your tax bill, street address, city, state, and zip code. If the notice should be sent to a different address, fill in that information as well.

- Indicate whether you want the Board of Review to make its decision based solely on the evidence you provide or if you wish to present your case in person at a hearing. Provide your mailing address, email address, and phone number.

- State the assessment year related to your complaint (for example, 2014).

- Check the appropriate reasons for your objection to the assessment, including any relevant descriptions that may apply, such as duplicate assessment or incorrect property description.

- Provide any additional relevant information that might assist the Board of Review in hearing your complaint.

- Complete the assessed values of your property as of January 1, 2014. Enter both the assessed values and your estimates for the correct values for land/lot or farm homesite, non-farm buildings and total assessment.

- Sign the form, certifying that all evidence supporting your complaint is attached. Include the property owner's or authorized agent's signature and the date.

- Mail your completed IL PTAX-230 form to the Clinton County Board of Review at the specified address.

Complete your documents online today for a smoother filing experience.

The success of property tax appeals relies on the strength of the evidence presented and adherence to local regulations. Many homeowners find success by preparing a well-documented appeal and using the IL PTAX-230 form to articulate their case. Additionally, seeking assistance through uslegalforms can enhance your understanding of the process and improve your chances of a successful appeal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.