Loading

Get Ca Calstrs Es 1161 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CALSTRS ES 1161 online

Filling out the CA CALSTRS ES 1161 form online is a straightforward process. This guide will help you navigate each section of the form efficiently, ensuring you provide all necessary information for eligibility in the Reduced Workload Program.

Follow the steps to complete the CA CALSTRS ES 1161 form online.

- Press the ‘Get Form’ button to retrieve the form and open it for editing.

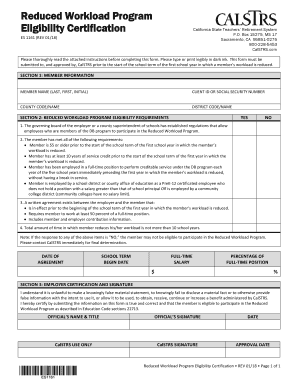

- In Section 1, enter the member's full name, Client ID or Social Security Number, and provide the county and district codes and names.

- In Section 2, assess eligibility requirements. For each item listed, mark the corresponding ‘YES’ or ‘NO’ box. Ensure to review every requirement closely, as a 'NO' response may affect eligibility.

- Fill in the Date of Agreement, which should be before the school term begin date. Specify the Full-Time Salary, reflecting what the member would earn if employed full-time, and indicate the Percentage of Full-Time Position the member will reduce their workload to.

- In Section 3, the official must certify the information. Enter the official's name and title, obtain their signature, and date this section to validate the form before submission.

- Finally, save the changes made to the form, then proceed to download, print, or share the form as necessary.

Complete the CA CALSTRS ES 1161 form online to ensure timely submission.

Workload reduction means decreasing the amount of work or hours without losing associated benefits. For educators in California, this could mean engaging with students less frequently while still retaining critical retirement and pension benefits. Understanding workload reduction can aid educators in planning their careers more effectively. Uslegalforms provides resources that can help clarify these concepts further.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.