Loading

Get Mn Form 10.1.1 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN Form 10.1.1 online

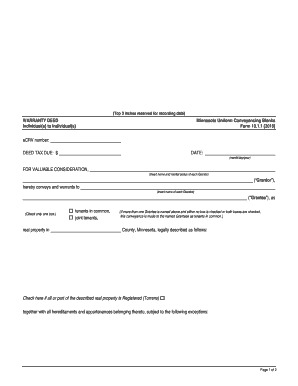

The MN Form 10.1.1 is a vital document used for the conveyance of real property in Minnesota. This guide will provide a clear and supportive walkthrough for filling out the form online.

Follow the steps to complete the MN Form 10.1.1 effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the 'eCRV number' and the 'DEED TAX DUE' amount, as applicable. Ensure these fields are filled accurately to avoid any delays in processing.

- Enter the date in the format of month/day/year. This date is crucial as it indicates when the conveyance takes effect.

- In the section titled 'FOR VALUABLE CONSIDERATION,' identify the type of property representation by checking only one box: ‘tenants in common’ or ‘joint tenants’. This will define the ownership arrangement between the parties involved.

- Insert the names and marital status of each Grantor in the designated fields. This is essential to clarify who is conveying the property.

- Next, list the names of each Grantee involved in the transaction. This needs to be precise to ensure correct title transfer.

- Provide a detailed description of the real property being conveyed, including the county of Minnesota where it is located.

- If applicable, check the box indicating whether all or part of the property is Registered (Torrens). This will determine the legal framework governing the property rights.

- Certify the status of any wells on the property by selecting the appropriate option, and if there are any, ensure a well disclosure certificate accompanies the document.

- Both Grantors must sign the document in the signature section provided. Ensure all signatures are accurately placed.

- Have the notarial officer acknowledge the instrument by filling in the required details, including their signature, title, and commission expiration date.

- Finally, specify the address where tax statements for the property should be sent. This ensures the Grantee receives timely information regarding property taxes.

Complete your MN Form 10.1.1 online to ensure a smooth process in transferring real property.

Filling out the MN Form 10.1.1 requires you to provide basic information about the property and the parties involved. Start by entering the name of the grantor and the grantee, followed by the legal description of the property. Make sure to sign the form in front of a notary public to ensure it is valid and can be recorded.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.