Get In Form 51766 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form 51766 online

This guide provides a clear and supportive approach to filling out the IN Form 51766 online. Whether you are a property owner preparing for a compliance review or a user unfamiliar with legal forms, this step-by-step guide will help you navigate the process efficiently.

Follow the steps to complete the form accurately online.

- Press the ‘Get Form’ button to access the IN Form 51766 and open it in your browser for editing.

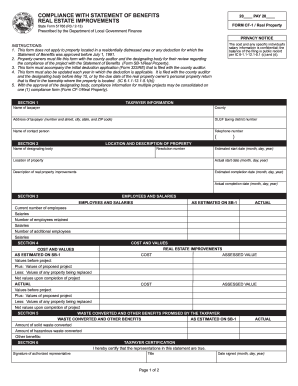

- In Section 1, enter your taxpayer information, including your name, county, address (number and street, city, state, and ZIP code), DLGF taxing district number, contact person's name, and their telephone number.

- Proceed to Section 2, where you will provide the location and description of the property. Fill out the name of the designating body, resolution number, estimated start date, actual start date, description of real property improvements, estimated completion date, and actual completion date.

- In Section 3, input information about employees and salaries. Include the current number of employees, their salaries, number of employees retained, their salaries, number of additional employees, and their respective salaries.

- Next, complete Section 4 by entering the cost and values as estimated on Form SB-1. Provide values before the project, values of the proposed project, values of any property being replaced, and net values upon completion of the project.

- Continue to Section 5 to report waste converted and other benefits promised by the taxpayer. Fill in the amounts for solid waste and hazardous waste converted along with any other benefits.

- In Section 6, the authorized representative must sign and certify that the information provided is true. Include their title and the date signed.

- Once you have filled out all sections, review the form for accuracy. Save your changes, and download or print the completed form for submission.

Take action now and complete your IN Form 51766 online for a smooth filing experience.

State Form 53569 is specifically used for personal property assessment in Indiana. This form supports property owners in reporting their business personal property, which is essential for accurate tax levies. If you are dealing with property taxes, also consider the IN Form 51766 as part of your overall strategy. For clarity on how to utilize these forms, turn to uslegalforms for assistance in your property tax filings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.