Loading

Get Il Il486-1880 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL IL486-1880 online

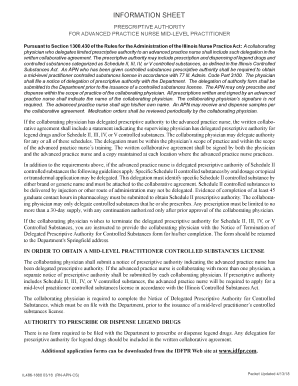

This guide provides clear instructions on how to fill out the IL IL486-1880 form online for advanced practice nurses seeking a mid-level practitioner controlled substances license. We will walk you through each section of the form to ensure a smooth application process.

Follow the steps to complete your application accurately.

- Press the ‘Get Form’ button to access the IL IL486-1880 document in the editor.

- Fill out Part I by indicating the application category information. Include the profession name as 'Advanced Practice Nurse Mid-Level Practitioner Controlled Substances License' and the associated profession code.

- In Part III, answer the personal history questions honestly and completely. Attach any required documentation if you answer 'yes' to any of the questions.

- In Part V, review your application for accuracy and completeness before signing the certifying statement. Ensure you date your application.

Start your application process online today and take the next step in your professional practice.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You must file your Illinois estate tax return with the Illinois Department of Revenue. This typically involves submitting Form IL IL486-1880 along with any required documentation. Ensure your filing is complete and accurate to avoid delays in processing your estate taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.