Get Za Sars Vat101 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZA SARS VAT101 online

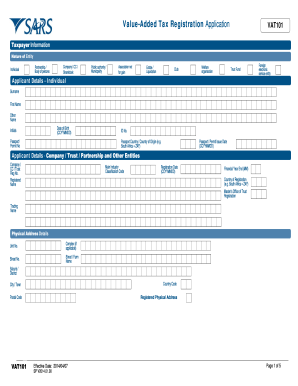

The ZA SARS VAT101 form is essential for submitting a Value-Added Tax registration application. This guide will help you navigate the online filling process, ensuring you complete each section accurately and efficiently.

Follow the steps to successfully fill out the ZA SARS VAT101 online.

- Click ‘Get Form’ button to obtain the VAT101 form and open it in the editor.

- Begin by selecting your entity type: individual, partnership, company, or other. Ensure you accurately check the corresponding box.

- Fill in your personal information in the 'Applicant Details – Individual' section, including your surname, first name, and date of birth in the specified format (CCYYMMDD). Provide your ID or passport number alongside your country of origin.

- If applying as a company or trust, complete the 'Applicant Details Company / CC / Trust' section, listing your registration number, registered name, and main market classification code.

- Input your registered physical address, specifying unit number, street and suburb, as well as the postal code.

- Populate the financial particulars section. Indicate whether your business is compulsory or voluntary, and provide accurate values for taxable supplies, ensuring compliance with the R50,000 threshold as applicable.

- Select your payment basis, choosing between invoice and payments basis, ensuring the selection meets the criteria specific to your entity.

- List the particulars of partners, members, or directors as needed, ensuring all required fields are accurately filled such as names, identity numbers, and their roles.

- Attach required documentation such as identity proofs, business registration certificates, and financial statements, ensuring all documents are current and complete.

- Once everything is complete, review your entries for accuracy, and save your progress. Download, print, or share the form as needed before submitting.

Start filling out your ZA SARS VAT101 application online today for a seamless registration process.

Get form

To make a VAT payment to SARS, you can use several methods, including electronic funds transfer or using the online payment option through SARS eFiling. Ensure that you reference your VAT registration number when making the payment. It’s important to complete your payment before the deadline to avoid penalties. For assistance in navigating these processes, consider platforms like uslegalforms, which provide valuable resources and templates.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.