Get Uk Hmrc Iht404 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

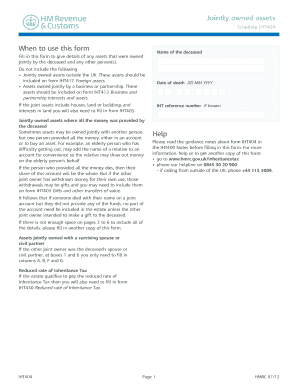

How to fill out the UK HMRC IHT404 online

Filling out the UK HMRC IHT404 form can seem daunting, but this guide will help you navigate each section with confidence. Whether you are experienced with legal documents or new to the process, you'll find step-by-step instructions tailored to your needs.

Follow the steps to complete the IHT404 form online effectively.

- Press the ‘Get Form’ button to access the form and open it for completion.

- Begin filling in the name of the deceased in the appropriate field. Ensure that the name matches official identification documents to avoid any discrepancies.

- Enter the date of death in the format DD MM YYYY. This information is crucial for the accurate processing of the form.

- In box 1, list all jointly owned assets. For each asset, provide a brief description, the names of the other joint owners, the date ownership started, the contribution by each owner, and the total value of the asset.

- If there are any liabilities against the jointly owned assets, such as mortgages, include them in box 2. Provide a description, creditor name, and total amount outstanding.

- Box 4 is for exemptions and reliefs. Report any applicable reliefs deducted from the jointly owned assets, including details on charities if applicable.

- In box 6, detail other jointly owned assets not included in box 1, following the same format. If none exist, enter '0'.

- Box 7 is for other liabilities as described in box 6. List relevant information similarly to step 5.

- Ensure to fill out box 11 regarding survivorship assets, indicating whether any of the listed assets passed by survivorship and entering details as necessary.

- Review all information entered for accuracy. Once final, save your changes, and you may download, print, or share the completed form as required.

Start completing your IHT404 form online today and ensure your details are submitted accurately.

Get form

You can give your house to your son, but you may still face potential Inheritance Tax implications under certain conditions. If you continue living in the home after the transfer, it could still be counted as part of your estate under the UK HMRC IHT404 guidelines. Therefore, careful planning is necessary to ensure this strategy is effective. Seeking advice on the matter can help safeguard your assets.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.