Get Form Enr 301

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Enr 301 online

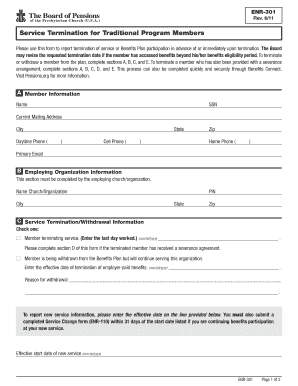

This guide is designed to help users navigate the process of completing the Form Enr 301 for service termination for traditional program members. Whether you are completing the form for yourself or on behalf of another, the following steps will provide clear instructions to ensure accurate submission.

Follow the steps to successfully complete the Form Enr 301 online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- In section A, provide your personal information, including your name, Social Security Number (SSN), mailing address, and phone numbers. Make sure to enter your primary email address for communication purposes.

- Proceed to section B, where the employing organization’s information is required. Fill in the name of the church or organization, its city, state, and postal code (ZIP). This section must be completed by the employing organization.

- Move on to section C to report your service termination or withdrawal. Specify whether you are terminating service or being withdrawn from the benefits plan while continuing to serve. Enter the last day worked or the effective date of termination of employer-paid benefits, and provide a reason for withdrawal if applicable.

- If applicable, complete section D, which pertains to severance arrangements. Indicate the severance payment amount and whether the arrangement involves an extension of plan benefits. Make sure you understand the implications regarding dues and benefit extensions.

- Finally, in section E, obtain the required signatures from both the authorized representative of the employing organization and yourself. Ensure the date is correctly filled in to validate the form.

- Once you have completed all sections, review the form for accuracy. You can then save your changes, download a copy for your records, print the form, or share it as needed.

Complete the Form Enr 301 online efficiently by following these steps.

Form NR303 is used by non-residents to claim exemptions from certain U.S. taxes. It helps individuals certify their foreign status and eligibility for benefits under tax treaties. Understanding Form Enr 301 is also vital, as the two forms often work together in managing tax obligations. By using both forms correctly, you can ensure compliance and potentially lower your tax liabilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.