Loading

Get Uk Ca72b 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK CA72B online

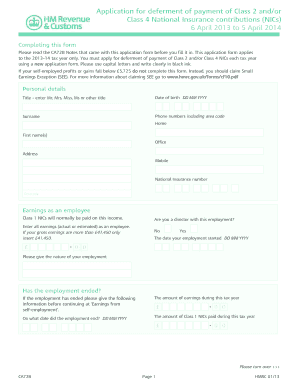

The UK CA72B form is an essential document for individuals seeking deferment of payment for Class 2 and/or Class 4 National Insurance contributions for the 2013-14 tax year. This guide provides clear and comprehensive instructions to help users complete the form correctly and efficiently.

Follow the steps to successfully complete the UK CA72B form online.

- Click the ‘Get Form’ button to access the CA72B form and open it in your selected online editor.

- Fill in your personal details carefully. This includes your title, date of birth, surname, first name(s), phone numbers, National Insurance number, and postcode. Use capital letters and black ink.

- In the 'Earnings as an employee' section, provide all earnings (actual or estimated). If your gross earnings exceed £41,450, only enter £41,450. Indicate if you are a director and provide your employment start date.

- If your employment has ended, specify the end date and include the amount of earnings and Class 1 NICs paid during the tax year.

- Move to the 'Earnings from self-employment' section. Enter your Self Assessment tax reference number and all relevant earnings. Again, if your earnings are over £41,450, enter £41,450.

- State the nature of your self-employment and the date your self-employment started.

- In the declaration section, check the box if you want HM Revenue & Customs to deal with a third party, and ensure to sign and date the declaration.

- Finally, ensure that the form is completed in full. Save your changes, and you can choose to download, print, or share the completed form as needed.

You can complete your CA72B form online to ensure a smooth deferment application process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

National Insurance contributions in the UK are calculated based on your earnings and the category of National Insurance you fall under. These contributions are essential for qualifying for certain benefits, including the state pension. To understand your obligations and ensure compliance with UK CA72B, reviewing your earnings is crucial.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.