Loading

Get Uk Psm65 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK PSM65 online

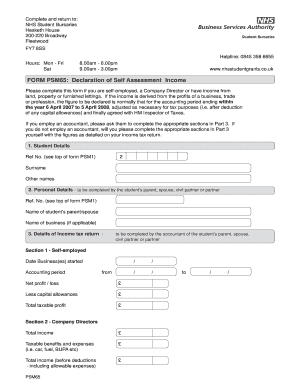

The UK PSM65 is a crucial form for individuals who are self-employed, company directors, or have income from land and property. This guide will provide clear, step-by-step instructions on how to fill out the form accurately online, ensuring a smooth submission process.

Follow the steps to fill out the UK PSM65 online successfully.

- Press the ‘Get Form’ button to access the form and begin the filling process.

- In Section 1, provide your student details including your reference number found at the top of form PSM1, your surname, and any other names.

- In Section 2, enter the personal details required to be filled by the student's parent, spouse, civil partner, or partner, including their name and the name of the business if applicable. Include the reference number as indicated.

- If applicable, in Section 3, provide details regarding income tax returns. For self-employed individuals, specify the date business activities started, the accounting period, and document the net profit or loss, capital allowances, and total taxable profit.

- For company directors, detail the total income and any taxable benefits, ensuring to include all allowable expenses.

- In Section 4, identify and record deductions and reliefs allowable for tax purposes including loan interest, retirement annuity contributions, personal pension amounts, and any professional fees.

- Finally, in Section 5, complete the declaration by signing and dating the form. If your accountant is assisting, ensure they sign and stamp the form in the designated area.

- After completing all sections, save your changes. You may then download, print, or share the completed form as necessary.

Complete the UK PSM65 form online today to ensure your submission is accurate and timely.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Eligibility for visa sponsorship typically includes individuals who possess skills or qualifications that are in demand in the UK. Employers look for candidates who can fill specific roles effectively. Understanding the UK PSM65 rules can help both applicants and sponsors navigate the requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.