Get Form 5500-sf (pdf)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5500-SF (PDF) online

Filling out Form 5500-SF is an essential task for plan administrators to ensure compliance with reporting requirements. This guide provides clear and supportive instructions for completing the form online, making the process accessible to everyone, regardless of their experience level.

Follow the steps to complete your Form 5500-SF accurately.

- Press the ‘Get Form’ button to acquire the form, allowing you to access it for completion.

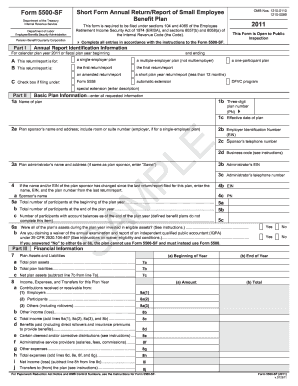

- Begin with Part I by checking the appropriate boxes that describe your plan type, indicating whether it is a single-employer plan or a multiple-employer plan. This section also requires marking if it’s a final return/report or a short plan year report.

- Move to Part II and complete the Basic Plan Information. Enter the name of the plan, the name and address of the plan sponsor, the plan administrator’s information, and any relevant changes since the last return.

- In Part III, provide the Financial Information pertaining to plan assets and liabilities. This includes reporting the total plan assets, liabilities, income, expenses, and net income or loss.

- Continue to Part IV to describe Plan Characteristics, offering codes for pension or welfare benefits if applicable.

- Next, address Part V by answering compliance questions to ensure adherence to fiduciary responsibilities and contributions.

- In Part VI, report on Pension Funding Compliance, indicating whether the plan is subject to minimum funding requirements and detailing contributions made.

- Complete Part VII if your plan has been terminated or if there are transfers of assets. Ensure correct tracking of asset distribution.

- Finally, review all the information entered for accuracy. Save your changes, then download or print the completed Form 5500-SF for submission.

Start filling out your Form 5500-SF online today to stay compliant with reporting regulations.

Form 5500-SF (PDF) is a tax form that simplifies the annual reporting requirement for small employee benefit plans, such as profit-sharing and retirement plans. This form provides necessary details about the plan's financial condition and operations but requires less information than the standard Form 5500. Filing this form accurately helps maintain compliance and informs the IRS about your plan's status. Choosing to file Form 5500-SF (PDF) helps you manage your reporting efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.