Loading

Get India Itr-v 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India ITR-V online

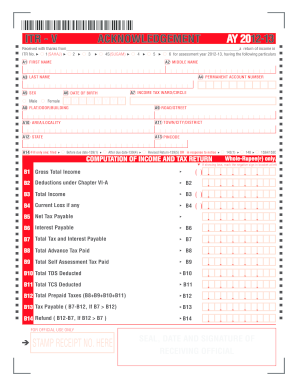

Filling out the India Income Tax Return - Verification (ITR-V) form online is a vital step for individuals submitting their income tax returns. This guide provides clear and supportive instructions to help users navigate through each section of the form seamlessly.

Follow the steps to complete your ITR-V form online

- Press the ‘Get Form’ button to obtain the form and open it in your preferred format for editing.

- Begin by filling in the personal details section. Enter your first name, middle name, and last name as required in fields A1, A2, and A3. Make sure these details match your official documents.

- Next, input your Permanent Account Number (PAN) in field A4, ensuring it is accurate to avoid any discrepancies.

- Provide your date of birth in field A6, selecting the correct day, month, and year. Indicate your gender by marking either the male or female option in field A5.

- Fill in your complete address, starting from field A8 (flat/door/building), continuing to A11 (town/city/district), and concluding with A12 (state) and A13 (pincode). This information is important for communication purposes.

- In section A14, specify the type of return you are filing by selecting one option to indicate whether it is filed before the due date, after due date, a revised return, or in response to a notice.

- Proceed to calculate your income and tax by entering your gross total income in field B1. Deduct any applicable deductions under Chapter VI-A in field B2.

- Calculate your total income by transferring the amount from B1 and deducting B2 into field B3. If you have any current loss, enter it in field B4.

- After determining your net tax payable in B5, include any interest payable in field B6, and calculate the total tax and interest payable in B7.

- Complete the tax payments by entering amounts for advance tax paid (B8), self-assessment tax paid (B9), total TDS deducted (B10), and total TCS deducted (B11). Finally, sum these into field B12 for total prepaid taxes.

- Calculate your total tax payable or refund in fields B13 and B14, making sure to apply the correct formulas based on your calculations.

- Once all sections are filled accurately, review your form for any errors before proceeding to save changes, download, print, or share your completed ITR-V form.

Start completing your India ITR-V form online today to ensure timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The time limit for submitting your ITR-V typically aligns with the filing deadlines set by the income tax department. To avoid complications, make sure to submit your ITR-V for verification within the stipulated time frame. This ensures compliance and aids in a smooth tax filing experience under India ITR-V.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.