Loading

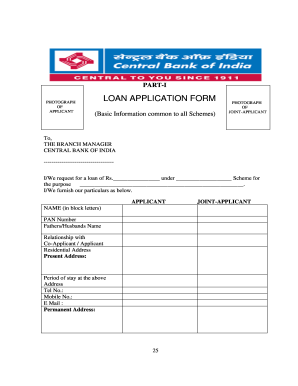

Get India Central Bank Loan Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Central Bank Loan Application Form online

Filling out the India Central Bank Loan Application Form online can be a straightforward process when approached methodically. This guide provides step-by-step instructions to help you successfully complete the application and maximize your chances of loan approval.

Follow the steps to complete the application form successfully.

- Click ‘Get Form’ button to obtain the loan application form and open it in the editor.

- Begin by completing the applicant section. Enter your name in block letters, PAN number, and the names of your father or partner. Indicate your relationship with the co-applicant, if applicable.

- Provide your residential address and present address, including the duration of stay at each location. Ensure you fill in your contact number, mobile number, and email address.

- Fill in the permanent address section. Include the necessary details for both the applicant and joint-applicant, if applicable. Indicate the residential status as either resident or non-resident.

- Complete the demographic section by providing age, date of birth, sex, marital status, category (SC/ST/OBC/GEN/Minority), and the number of dependents.

- In the employment details section, enter the particulars of your occupation, including the name of your employer or the nature of your business, and the relevant address and contact details.

- Provide your gross monthly income and details of deductions, leading to an accurate net salary or income figure. Attach proof of income where required.

- Detail your bank accounts, specifying the name of the bank, type of account, account number, and average credit balance for the last six months.

- If applicable, complete the section on existing loans. Provide details of any loans from Central Bank or other banks, including type, amount, and repayment status.

- List any other liabilities, including loans from employers, friends, or any other obligations.

- If you hold a credit card, complete the section with details about your credit card(s), including the issuing bank, credit limit, and outstanding amount.

- Provide comprehensive details about your assets, including cash, deposits, immovable assets with addresses and values, movable assets, and investments.

- Specify details of collateral security, including a description of the property and ownership information.

- Complete the guarantor section by providing names and addresses of any guarantors and their relevant information.

- Review all details you have entered to ensure accuracy. Finally, sign and date the form before submitting it online or printing it for submission.

Take the first step towards securing your loan by completing the application form online today.

A loan application form is a document used by banks to collect the relevant information from a potential borrower when applying for a loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.