Loading

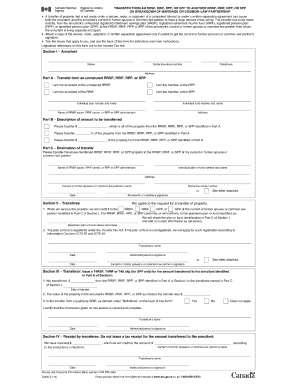

Get Canada T2220 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2220 online

Filling out the Canada T2220 form online can streamline your process for obtaining tax information. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Canada T2220 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your personal information in the designated fields. This includes your full name, address, and contact details. Make sure that your information is current and accurately reflects your legal name as it appears on official documents.

- Next, indicate your status by selecting the appropriate checkbox. This will determine your eligibility for specific tax situations outlined in the form.

- Proceed to provide detailed information regarding your income sources as requested in the form. Be thorough and ensure all entries are clear to avoid any misunderstandings during processing.

- Carefully review the deductions you wish to claim, ensuring they comply with relevant tax laws. This section may require additional documentation so keep that in mind.

- Once all fields are completed, go through the form one last time to check for any errors or missing information. It is essential to ensure accuracy to facilitate a smooth review process.

- After confirming that all information is correct, you can save changes, download, print, or share the form through the options provided in the editor.

Complete your documents online to ensure timely submission and processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The new $7500 tax credit in Canada aims to support specific economic activities, such as green initiatives or first-time home purchases. This incentive encourages taxpayers to invest in eligible areas that contribute positively to the economy. Be sure to consider how this could integrate with your overall tax strategy, including the insights from the Canada T2220. Updated information is often available on tax platforms to help clarify eligibility and application processes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.