Loading

Get Canada T2209 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2209 online

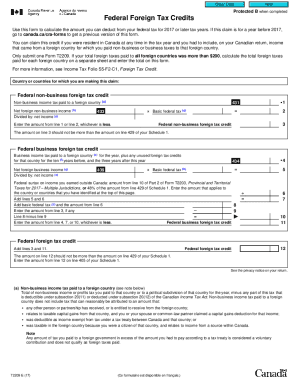

The Canada T2209 form is essential for calculating the federal foreign tax credit that you can deduct from your income tax. This guide will provide you with clear, step-by-step instructions to complete the form online, ensuring you take full advantage of the credits available to you.

Follow the steps to accurately fill out the T2209 form online.

- Press the ‘Get Form’ button to access and open the Canada T2209 form in your preferred online editor.

- In the section labeled 'Country or countries for which you are making this claim', list each foreign country from which you received income and for which you paid taxes.

- For 'Non-business income tax paid to a foreign country', record the total amount of non-business income tax you paid for the year.

- Next, calculate your 'Net foreign non-business income' by providing the figures that include deductions and allowable expenses.

- Proceed to calculate your 'Basic federal tax' by following the instructions to add relevant figures from your Schedule 1, ensuring clarity on deductions applicable.

- For the 'Federal non-business foreign tax credit', enter the lesser of the figures from your calculations to reflect the maximum credit you can claim.

- Continue to the section for 'Business income tax paid to a foreign country', where you will need to report similar values as above for any business income received.

- Lastly, ensure that you review all entries. Once you have completed the form accurately, you can save changes, download, print, or share the T2209 form as required.

Begin filling out the Canada T2209 form online today to ensure you maximize your eligible foreign tax credits.

To avoid double taxation in Canada, utilize the foreign tax credit available through your tax return. Ensure you accurately fill out the Canada T2209 form, detailing your foreign income and taxes. By understanding your rights under tax treaties and applying the credits available, you can mitigate the effects of being taxed twice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.