Loading

Get Payee Data Record - California State University San Marcos - Csusm

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Payee Data Record - California State University San Marcos - Csusm online

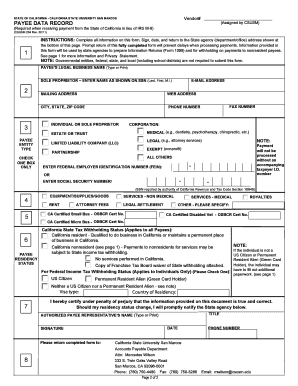

Filling out the Payee Data Record for California State University San Marcos is a crucial step for non-governmental entities seeking payment. This guide will provide you with comprehensive instructions to complete the form efficiently and accurately.

Follow the steps to successfully fill out the Payee Data Record.

- Click ‘Get Form’ button to obtain the form and open it in the editor for completion.

- Enter the payee's legal business name. If you are a sole proprietorship, include the owner's full name. For individuals, provide your complete name as well. The mailing address should be where you wish to receive correspondence, avoiding any payment addresses.

- Check the box that corresponds to the payee business type. Select only one box. Corporations must specify their type. Ensure you provide your Taxpayer Identification Number (TIN) as required.

- Indicate the primary business activities by checking the relevant boxes that describe the services or goods offered.

- Complete the small business and Disabled Veteran Business Enterprise (DVBE) information by checking applicable boxes and providing the OSBCR Certification Number.

- Determine your California residency status. Review the definitions provided to classify yourself accurately, as this will affect potential tax withholdings. Nonresidents performing services in California should be aware of withholding rules.

- Provide the name, title, signature, and telephone number of the individual completing the form and include the date of completion.

- Finally, submit the completed form to the designated contact at the California State University San Marcos Accounts Payable Department to avoid delays in payment processing.

Complete your Payee Data Record online today to ensure timely processing of your payments.

To send your California state tax payment, locate the address on your tax return forms, as it may vary depending on your specific situation. Payments can often be mailed to the Franchise Tax Board's designated addresses for personal or business tax. For further clarity, the Payee Data Record - California State University San Marcos - Csusm can offer guidance on proper submission procedures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.