Loading

Get Canada T2 - Schedule 91 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2 - Schedule 91 online

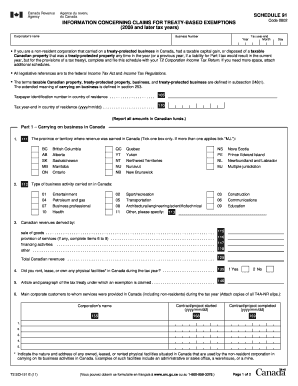

This guide provides clear and comprehensive instructions on how to complete the Canada T2 - Schedule 91 online. Designed for non-resident corporations, this form is essential for claiming treaty-based exemptions related to business activities in Canada.

Follow the steps to fill out the Canada T2 - Schedule 91 online.

- Click ‘Get Form’ button to obtain the form and access it in your preferred online environment.

- Enter the corporation's name in the designated field, ensuring the accuracy of the spelling.

- Provide the business number associated with your corporation, which can typically be found on previous tax documents.

- Indicate the tax year for which you are filing by filling in the appropriate year.

- Select the tax year-end by entering the month and day in the specified format.

- If applicable, identify if your non-resident corporation carried on a treaty-protected business in Canada, dispossessing of taxable Canadian property using the relevant checkboxes.

- Fill in the taxpayer identification number for your corporation’s country of residence.

- Complete the tax year-end date in your country of residence in the specified format.

- Provide detailed information about your carrying on business in Canada, including selecting the province or territory where revenue was earned by ticking the appropriate box.

- Specify the type of business activities carried on in Canada, selecting the most applicable description.

- Report total Canadian revenues derived from sales, services, and other activities accurately in the provided fields.

- Indicate whether you rented, leased, or owned any physical facilities in Canada during the tax year, ticking yes or no.

- Enter the article and paragraph of the tax treaty under which you claim an exemption.

- List your main corporate customers and provide the start and completed dates of contracts during the tax year, along with required attachments.

- Document any Canadian resident and non-resident employees in your company, including total amounts paid.

- Complete sections regarding subcontractors, similar to the employee section, detailing payments and engagement dates.

- If applicable, indicate whether you have applied for a waiver of the withholding requirement.

- Complete Part 2 regarding disposing of taxable Canadian property with thorough descriptions and amounts.

- After completing all sections, review the information provided for accuracy.

- Finally, save changes, download, print, or share the filled form as needed.

Start filing your Canada T2 - Schedule 91 online today for a seamless experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The T2 tax form is a Canadian corporate tax return that corporations must file annually. This form outlines taxable income, deductions, and taxes owed. Understanding the Canada T2 - Schedule 91 is essential, as it details the calculation of taxes for specific types of income reported on the T2.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.