Get Canada Sc Isp-3520 E 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada SC ISP-3520 E online

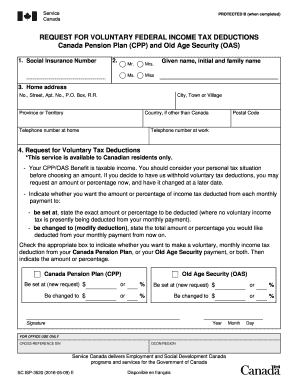

Filling out the Canada SC ISP-3520 E form online is an essential step for individuals looking to make voluntary federal income tax deductions from their Canada Pension Plan and Old Age Security payments. This guide will provide you with a clear and straightforward approach to completing the form efficiently.

Follow the steps to complete the Canada SC ISP-3520 E form online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your social insurance number in the designated field to identify your income tax deductions accurately.

- Indicate your title by selecting one of the options: Mr., Mrs., Ms., or Miss. Then, provide your given name, initial, and family name.

- Fill in your home address, including number, street, apartment number (if applicable), city or town, province or territory, country (if not Canada), postal code, and your contact numbers for home and work.

- In the 'Request for Voluntary Tax Deductions' section, note that this service is available only to Canadian residents. You should consider your personal tax situation when choosing an amount for deductions.

- Select whether you would like to set a new request for deduction or modify an existing deduction by selecting the appropriate option for either Canada Pension Plan or Old Age Security payments.

- Specify the amount or percentage you wish to deduct from each monthly payment by entering the desired figures in the provided fields.

- Carefully review all the entered information for accuracy and completeness before proceeding.

- Once you have confirmed that all information is correct, you can save your changes, and select whether to download, print, or share the completed form.

Start completing your documents online today to manage your tax deductions effectively.

Yes, as a U.S. resident, you must declare your Canada Pension Plan (CPP) benefits on your U.S. tax returns. The U.S. has tax treaties with Canada that may help you avoid double taxation. It’s advisable to consult a tax professional familiar with cross-border taxation to understand your obligations. If you need documentation for tax purposes, uslegalforms can help you find what you need.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.