Get Canada Alberta At4930 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Alberta AT4930 online

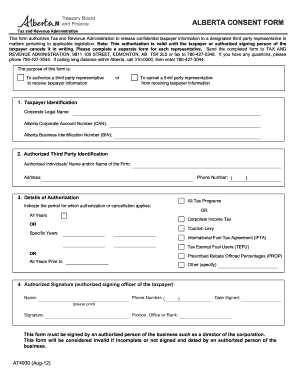

The Canada Alberta AT4930 form is essential for authorizing the Tax and Revenue Administration to release confidential taxpayer information to a designated third party. This guide will provide you with clear, step-by-step instructions to ensure a complete and accurate submission of the form online.

Follow the steps to successfully complete the Canada Alberta AT4930 form.

- Press the ‘Get Form’ button to obtain the Canada Alberta AT4930 form and open it in the editor.

- Begin by filling out the 'Taxpayer Identification' section. Provide the corporate legal name, Alberta Corporate Account Number (CAN), and Alberta Business Identification Number (BIN) accurately.

- Proceed to the 'Authorized Third Party Identification' section. Enter the name of the authorized individual or the firm, their phone number, and their address.

- In the 'Details of Authorization' section, select whether this authorization applies to all tax programs or specific ones. Indicate the applicable period, whether it is for specific years or all years.

- Next, complete the 'Authorized Signature' section. Ensure that the signature is provided by an authorized signing officer of the taxpayer, such as a director of the corporation. Fill in their name, phone number, date signed, and position.

- Review the form carefully. This form will be invalid if incomplete or not signed and dated by an authorized person. Ensure all information is correct and complete.

- Finally, save your changes and choose to download, print, or share the completed form as needed.

Complete and submit your Canada Alberta AT4930 form online today to ensure efficient processing of your authorization.

Get form

Alberta operates with a unique tax structure, notably not having a provincial sales tax. The province does collect income tax and various fees, which help fund public services. Residents and businesses benefit from a straightforward tax system that supports community growth. Understanding the intricacies of taxation is crucial, and resources like US Legal Forms can assist you in navigating Alberta Canada AT4930's tax landscape.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.