Loading

Get Canada Flr-13-e 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada FLR-13-E online

This guide provides comprehensive instructions for filling out the Canada FLR-13-E form online. By following these steps, users of all backgrounds can ensure they complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

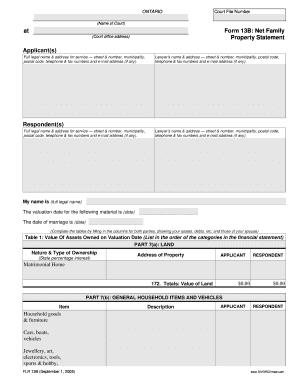

- Enter your court file number at the top of the form to identify your case.

- Provide the full legal name and address for service of the applicant and, if applicable, their lawyer.

- Fill in the respondent's full legal name and address for service, along with their lawyer's information, if they have one.

- State your full legal name, the valuation date of the property, and the date of your marriage.

- Complete the tables that ask for details about assets and debts for both parties, ensuring you accurately list all relevant items.

- For each category, such as land, vehicles, and bank accounts, provide specific values and details as requested in the form.

- After filling out all sections, review the form for accuracy and completeness.

- Once satisfied with the information provided, you can save the changes, download, print, or share the completed form.

Complete your Canada FLR-13-E online today to move forward with your process.

The 90% rule for newcomers in Canada indicates that to maintain your residency status, you must establish significant ties to the country. This means that at least 90% of your income should be sourced from Canadian earnings. This guideline is essential for newcomers and is relevant when filling out the Canada FLR-13-E to declare residency correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.