Get Dol Sample Wh-347 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DoL Sample WH-347 online

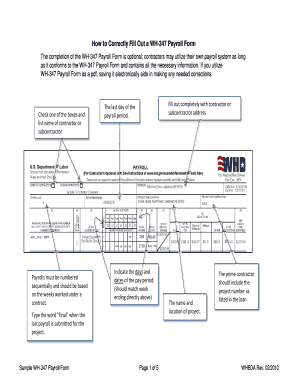

The DoL Sample WH-347 Payroll Form is essential for contractors and subcontractors to report wages and other pertinent information related to labor under government contracts. This guide provides you with clear, step-by-step instructions to successfully complete the form online.

Follow the steps to complete your WH-347 Payroll Form with ease.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Select your status by checking one of the boxes to indicate whether you are a contractor or subcontractor. Provide the name of the entity you represent.

- Number your payrolls sequentially. Ensure that the payrolls are based on the weeks worked under the contract to maintain clarity and organization.

- Fill in your address details completely, including contact information for the contractor or subcontractor.

- Enter the last day of the payroll period. This should correspond with the overall project schedule.

- Indicate the specific days and dates included in the pay period, ensuring these match the week ending date you noted earlier.

- If this is the final payroll submission for the project, type the word 'Final' in the appropriate field.

- Document the name and location of the project, along with the project number as listed in the loan.

- List each worker's name who is involved in the construction work under the contract. Include only laborers and mechanics.

- Specify the job classification as indicated in the contract wage decision. Make sure to include the corresponding job title for each worker.

- Business owners should ensure they include their name, work classification (including 'owner'), and the total hours worked each day.

- Document the hourly wage rate and any fringe benefits paid in cash, clearly separating those not paid to plans.

- Specify the net amount paid to each employee during the payroll period to ensure accuracy and compliance.

- Record the total overtime and straight time hours worked under the project. Ensure this reflects the actual hours worked per the contract.

- Clearly indicate the gross earnings based on the hours worked under the contract.

- If a worker's wages were earned on multiple projects, enter the gross amount for this contract in the specified section, while also reporting their total earnings from all projects.

- If a worker performs multiple job classifications, use separate lines for clarity regarding hours and wages earned.

- Ensure the payroll includes details for registered apprentices, their pay scale, and a copy of the apprenticeship agreement.

- Provide explanations for 'other' deductions on the signatory page to maintain transparency.

- Double-check all fields for accuracy before proceeding with saving. Once completed, you can save your changes, download, print, or share the filled-out form.

Complete your WH-347 Payroll Form online today for a streamlined reporting process.

You should use the DoL Sample WH-347 whenever you are required to report fringe benefits for employees working on federally funded contracts. It is important to fill out this form with each payroll submission to ensure that you are compliant with U.S. Department of Labor requirements. Using this form at the appropriate times helps prevent potential legal issues and maintains transparency with labor regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.