Loading

Get Dol 5500 - Schedule I 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DoL 5500 - Schedule I online

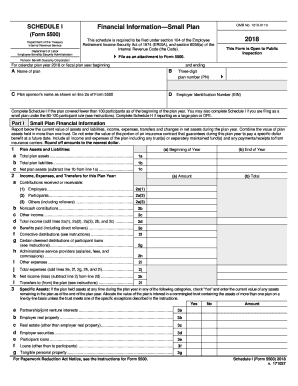

Filling out the DoL 5500 - Schedule I can seem daunting, but with careful attention to detail, you can complete the form accurately. This guide provides a comprehensive overview of each section, ensuring you have the necessary tools to submit the form effortlessly.

Follow the steps to successfully complete the Schedule I.

- Use the ‘Get Form’ button to obtain the Schedule I form and open it in your preferred online editing tool.

- In the first section, enter the name of the plan as required. Ensure that all characters match exactly as they are referenced in official documents.

- Proceed to Part I where you will report the financial information. Begin with reporting total plan assets and total liabilities. Make sure to calculate net plan assets by subtracting total liabilities from total assets.

- Next, input the income information for the plan year. List contributions received from employers, participants, and others. Include any noncash contributions and other income relevant to the plan.

- Detail the expenses associated with the plan. Include benefits paid, administrative expenses, and any other related costs. Remember to calculate total expenses accurately.

- Complete Part II by answering the compliance questions. These are crucial for ensuring regulatory adherence and their answers will influence the plan's compliance status.

- Review the completed form for accuracy. Any errors can lead to complications in processing. Make sure all information is filled correctly and all calculations are verified.

- Once you confirm all information is accurate, save your changes, download a copy of the form, or share it as needed for submission.

Begin filling out your Schedule I online to ensure compliance and accuracy in your reporting.

The DoL 5500 is a general report that outlines the financial status of employee benefit plans, while the DoL 5500 SF is a simplified version for smaller plans. Understanding this distinction is crucial for compliance. If you run a larger plan, you will use the standard 5500 form, but if your plan has fewer than 100 participants, the 5500 SF can save you time and effort in reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.