Loading

Get Bexar Appraisal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bexar Appraisal online

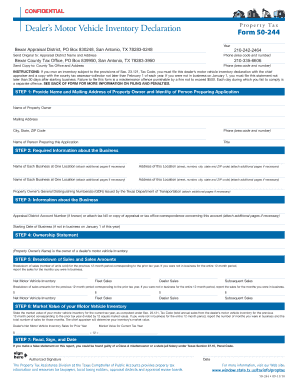

Filing the Bexar Appraisal is a crucial step for property owners in Bexar County. This comprehensive guide outlines the step-by-step process for completing the appraisal online, ensuring accuracy and efficiency in your submissions.

Follow the steps to successfully complete your Bexar Appraisal form.

- Click ‘Get Form’ button to access the Bexar Appraisal document and open it in your preferred editing tool.

- Provide the name and mailing address of the property owner. Ensure that all information is accurate, including the city, state, and ZIP code. Also, include the phone number of the property owner and the name of the person preparing the application along with their title.

- Enter the required information about the business. This includes the physical address where the business operates. Attach additional pages if necessary for any further details.

- Field for ownership statement. Confirm the ownership of the property by indicating the property owner's name.

- Complete the breakdown of sales and sales amounts section. Include details for net motor vehicle inventory, fleet sales, dealer sales, and subsequent sales. Ensure to report sales figures accurately for the relevant months.

- Calculate the market value of your motor vehicle inventory based on the reported sales figures. If your business was not operational for the full year, indicate the number of months you were active to adjust your market value accordingly.

- Read, sign, and date the completed form. Be aware that inaccuracies may have legal consequences.

- Once all sections are filled out accurately, proceed to save changes, download a copy for your records, print the document, or share it with the relevant authorities.

Start completing your Bexar Appraisal online today!

To qualify for the Bexar homestead exemption, you must own your home and use it as your primary residence. Additionally, you must apply for the exemption before the state deadline. This exemption can provide substantial savings on property taxes, making it financially advantageous for eligible homeowners. If you need assistance navigating the application process, US Legal Forms offers valuable resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.