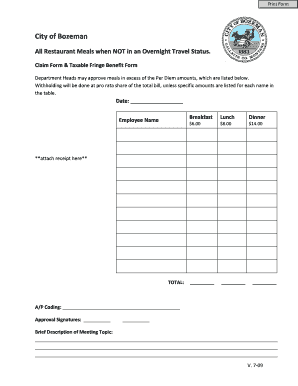

Get Claim Form & Taxable Fringe Benefit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign Claim Form & Taxable Fringe Benefit Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:The preparing of lawful paperwork can be costly and time-ingesting. However, with our preconfigured web templates, things get simpler. Now, creating a Claim Form & Taxable Fringe Benefit Form takes a maximum of 5 minutes. Our state browser-based blanks and clear recommendations eradicate human-prone errors.

Adhere to our simple actions to have your Claim Form & Taxable Fringe Benefit Form ready rapidly:

- Pick the web sample from the library.

- Enter all necessary information in the required fillable areas. The easy-to-use drag&drop interface makes it simple to include or relocate areas.

- Make sure everything is filled out correctly, without any typos or lacking blocks.

- Apply your e-signature to the page.

- Simply click Done to confirm the alterations.

- Download the data file or print your copy.

- Submit immediately towards the receiver.

Use the fast search and innovative cloud editor to make a precise Claim Form & Taxable Fringe Benefit Form. Remove the routine and create papers online!

Tips on how to fill out, edit and sign Claim Form & Taxable Fringe Benefit Form online

How to fill out and sign Claim Form & Taxable Fringe Benefit Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The preparing of lawful paperwork can be costly and time-ingesting. However, with our preconfigured web templates, things get simpler. Now, creating a Claim Form & Taxable Fringe Benefit Form takes a maximum of 5 minutes. Our state browser-based blanks and clear recommendations eradicate human-prone errors.

Adhere to our simple actions to have your Claim Form & Taxable Fringe Benefit Form ready rapidly:

- Pick the web sample from the library.

- Enter all necessary information in the required fillable areas. The easy-to-use drag&drop interface makes it simple to include or relocate areas.

- Make sure everything is filled out correctly, without any typos or lacking blocks.

- Apply your e-signature to the page.

- Simply click Done to confirm the alterations.

- Download the data file or print your copy.

- Submit immediately towards the receiver.

Use the fast search and innovative cloud editor to make a precise Claim Form & Taxable Fringe Benefit Form. Remove the routine and create papers online!

How to edit Claim Form & Taxable Fringe Benefit Form: customize forms online

Sign and share Claim Form & Taxable Fringe Benefit Form together with any other business and personal documents online without wasting time and resources on printing and postal delivery. Take the most out of our online form editor using a built-in compliant eSignature tool.

Approving and submitting Claim Form & Taxable Fringe Benefit Form documents electronically is faster and more efficient than managing them on paper. However, it requires employing online solutions that ensure a high level of data safety and provide you with a certified tool for creating electronic signatures. Our robust online editor is just the one you need to complete your Claim Form & Taxable Fringe Benefit Form and other personal and business or tax templates in an accurate and suitable way in accordance with all the requirements. It features all the essential tools to quickly and easily complete, adjust, and sign documentation online and add Signature fields for other people, specifying who and where should sign.

It takes only a few simple actions to fill out and sign Claim Form & Taxable Fringe Benefit Form online:

- Open the selected file for further managing.

- Utilize the upper toolkit to add Text, Initials, Image, Check, and Cross marks to your sample.

- Underline the key details and blackout or remove the sensitive ones if required.

- Click on the Sign tool above and choose how you prefer to eSign your form.

- Draw your signature, type it, upload its image, or use an alternative option that suits you.

- Move to the Edit Fillable Fileds panel and drop Signature fields for other parties.

- Click on Add Signer and provide your recipient’s email to assign this field to them.

- Check that all information provided is complete and correct before you click Done.

- Share your documentation with others utilizing one of the available options.

When signing Claim Form & Taxable Fringe Benefit Form with our robust online editor, you can always be sure to get it legally binding and court-admissible. Prepare and submit paperwork in the most beneficial way possible!

Fringe benefits tax is a tax imposed on certain benefits that employers provide to employees. This tax ensures that such benefits are taxed similarly to wages, with employees using the Claim Form & Taxable Fringe Benefit Form to report these items. Properly managing and reporting these taxes is crucial for compliance and financial planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.