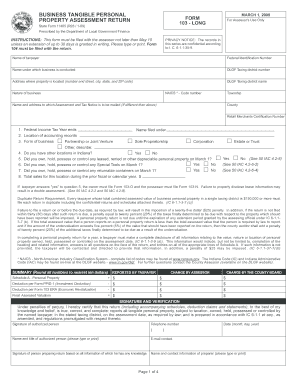

Get Business Tangible Personal Property Assessment Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:The days of frightening complex tax and legal forms have ended. With US Legal Forms the entire process of filling out official documents is anxiety-free. A powerhouse editor is already at your fingertips offering you a wide range of beneficial tools for submitting a BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN. These guidelines, with the editor will guide you with the entire procedure.

- Hit the Get Form button to start modifying.

- Switch on the Wizard mode in the top toolbar to get more recommendations.

- Fill out every fillable area.

- Ensure that the information you fill in BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN is updated and accurate.

- Indicate the date to the document using the Date feature.

- Click on the Sign tool and make a digital signature. You can find three available alternatives; typing, drawing, or capturing one.

- Make certain each field has been filled in properly.

- Click Done in the top right corne to save or send the file. There are many options for receiving the doc. As an instant download, an attachment in an email or through the mail as a hard copy.

We make completing any BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN less difficult. Use it now!

Tips on how to fill out, edit and sign BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN online

How to fill out and sign BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The days of frightening complex tax and legal forms have ended. With US Legal Forms the entire process of filling out official documents is anxiety-free. A powerhouse editor is already at your fingertips offering you a wide range of beneficial tools for submitting a BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN. These guidelines, with the editor will guide you with the entire procedure.

- Hit the Get Form button to start modifying.

- Switch on the Wizard mode in the top toolbar to get more recommendations.

- Fill out every fillable area.

- Ensure that the information you fill in BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN is updated and accurate.

- Indicate the date to the document using the Date feature.

- Click on the Sign tool and make a digital signature. You can find three available alternatives; typing, drawing, or capturing one.

- Make certain each field has been filled in properly.

- Click Done in the top right corne to save or send the file. There are many options for receiving the doc. As an instant download, an attachment in an email or through the mail as a hard copy.

We make completing any BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN less difficult. Use it now!

How to edit BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN: customize forms online

Have your stressless and paper-free way of working with BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN. Use our trusted online solution and save a lot of time.

Drafting every form, including BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN, from scratch requires too much time, so having a tried-and-tested platform of pre-drafted form templates can do magic for your productivity.

But working with them can be struggle, especially when it comes to the files in PDF format. Fortunately, our extensive catalog features a built-in editor that enables you to quickly complete and customize BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN without leaving our website so that you don't need to waste your precious completing your forms. Here's what to do with your form using our solution:

- Step 1. Locate the required form on our website.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Use our professional editing tools that allow you to insert, remove, annotate and highlight or blackout text.

- Step 4. Create and add a legally-binding signature to your form by utilizing the sign option from the top toolbar.

- Step 5. If the template layout doesn’t look the way you need it, use the tools on the right to remove, put, and re-order pages.

- step 6. Add fillable fields so other parties can be invited to complete the template (if applicable).

- Step 7. Share or send the form, print it out, or select the format in which you’d like to download the document.

Whether you need to execute editable BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT RETURN or any other template available in our catalog, you’re well on your way with our online document editor. It's easy and safe and doesn’t require you to have particular tech background. Our web-based tool is set up to deal with practical everything you can think of when it comes to file editing and execution.

No longer use outdated way of dealing with your documents. Choose a more efficient option to help you streamline your activities and make them less dependent on paper.

In Texas, a business personal property tax rendition is a report filed by businesses to declare their tangible personal property. This includes items like office furniture, machinery, or inventory. The purpose of the rendition is to inform local appraisal districts of the property owned and its value for taxation purposes. To simplify this process, you can utilize resources on the US Legal Forms platform.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.