Loading

Get Irs Form 5500 Ez 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 5500 Ez 2015 online

Filing the Irs Form 5500 Ez 2015 is an important task for one-participant retirement plans. This guide provides clear, step-by-step instructions to help users complete the form online with ease.

Follow the steps to fill out the Irs Form 5500 Ez 2015 accurately.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

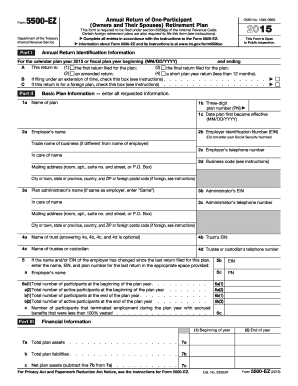

- In Part I, provide the identification information for the annual return. Indicate the plan year and check the appropriate box to specify if this return is the first, final, amended, or for a short plan year.

- Continue to Part II to enter the basic plan information. Fill in the name of the plan, the three-digit plan number, and the effective date of the plan, along with employer details including their name, identification number, and contact information.

- In Part III, provide financial information, including the total number of participants at both the beginning and end of the plan year. Record the total plan liabilities and net assets at the year's end.

- For Part IV, enter the applicable plan characteristics codes as required.

- In Part V, answer the compliance and funding questions honestly. Indicate if there were any participant loans or minimum funding requirement issues and provide relevant amounts.

- After completing all sections, carefully review the entries to ensure accuracy and completeness before submitting.

- Finally, users can save changes, download, print, or share the form as necessary.

Be sure to complete your forms online to ensure timely and accurate submission.

To search for a Form 5500, visit the official IRS website or use trusted legal resources. You can also utilize platforms like US Legal Forms, which provide streamlined access to necessary forms, including the IRS Form 5500 Ez 2015. This can help you find what you need quickly and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.