Loading

Get Schedule 390

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SCHEDULE 390 online

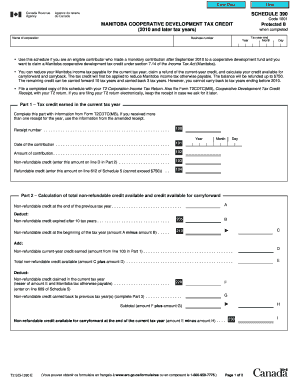

Filling out the SCHEDULE 390 form can be straightforward with the right guidance. This form is essential for claiming the Manitoba cooperative development tax credit for eligible contributions made after September 2010.

Follow the steps to fill out the SCHEDULE 390 form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part 1, where you will enter the receipt number associated with your contributions. This is crucial for verifying your contributions made during the current tax year.

- Next, provide the date of the contribution on the specified line. This should reflect the exact date when you made the monetary contribution to the cooperative development fund.

- Enter the total amount of your contribution in the designated field. Ensure this amount corresponds to the contributions documented on your receipt.

- Proceed to the section for non-refundable credit. Enter the amount you wish to claim on the line provided and subsequently on line D of Part 2.

- For refundable credit, note the amount that does not exceed $750, and enter this on the defined line as well.

- In Part 2, assess your total non-refundable credits available for carryforward. You will need to enter the non-refundable credits at the end of the previous tax year.

- Continue by calculating any non-refundable credits that expired after 10 tax years and enter this value for assessment.

- Add your current-year non-refundable credit earned from Part 1 to find the total non-refundable credit available.

- Finally, prepare for Part 3 to request for carryback of your non-refundable credit, and ensure this reflects against applicable tax years.

- After completing all sections, review your entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed form.

Complete the SCHEDULE 390 online to efficiently claim your Manitoba cooperative development tax credit.

To file an XBRL (Extensible Business Reporting Language) filing, you must prepare your financial information in a specific format. This ensures compliance with SEC requirements, similar to how you would navigate SCHEDULE 390 for tax forms. Platforms like uslegalforms offer tools and guidance that can simplify this complex process for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.