Loading

Get Ca Schedule P (541) 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Schedule P (541) online

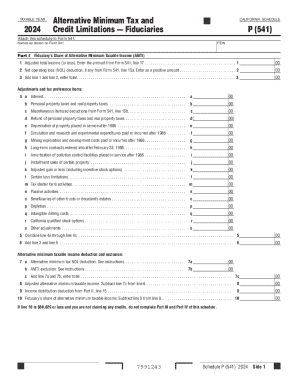

Filing the CA Schedule P (541) online requires careful attention to detail, as it is essential for reporting alternative minimum tax liabilities for fiduciaries. This guide provides a structured approach to ensure that users can accurately complete this form.

Follow the steps to fill out the CA Schedule P (541) online.

- Click ‘Get Form’ button to obtain the CA Schedule P (541) and open it in the editor.

- Begin by entering the name as shown on Form 541, and provide your Federal Employer Identification Number (FEIN). This information is critical as it identifies the fiduciary entity associated with the tax return.

- In Part I, start with line 1 by entering the adjusted total income or loss from Form 541. This figure serves as the basis for calculating alternative minimum taxable income (AMTI).

- On line 2, input any net operating loss (NOL) deduction from Form 541. If applicable, remember to enter this as a positive amount.

- Next, add the amounts from lines 1 and 2 and enter the total on line 3. This total is essential for further calculations.

- Proceed to line 4, where you will make various adjustments and report tax preference items such as interest and property taxes. Ensure each entry is accurate and corresponds to the requirements specified in the instructions.

- Complete lines 5 and 6 by combining your adjustments and adding them to the AMTI calculated earlier. This total will be used to determine your adjusted AMTI in line 8.

- In Part II, review your adjusted alternative minimum taxable income from line 8. This information will be utilized in the income distribution deduction calculations.

- Continue by advancing through the sections related to income distribution deductions and tentative minimum tax in Parts III and IV. Follow instructions carefully to ensure all deductions and credits are appropriately applied.

- Once all information has been entered and error-checked, you can save your changes, download the completed form, print it, or share it with relevant parties as needed.

Complete your CA Schedule P (541) online today for accurate tax reporting.

As a non-resident, you are required to file California state taxes if you earn income from California sources. This includes income generated from work performed in California or business conducted within the state. Understanding your filing requirements as a non-resident is essential for staying compliant with state laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.