Loading

Get Irs Charitable Contribution 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS CHARITABLE CONTRIBUTION 2009 online

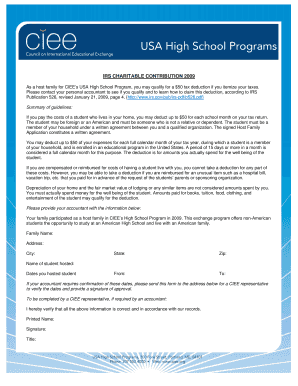

Filling out the IRS CHARITABLE CONTRIBUTION 2009 form can help you claim deductions for expenses related to hosting students through programs like CIEE's USA High School Program. This guide will provide you with clear and detailed instructions to complete the form accurately online.

Follow the steps to successfully fill out the IRS form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Locate the section for personal information. Fill out your family name, address, city, state, and zip code carefully.

- In the next section, provide the name of the student you hosted, ensuring accuracy in spelling.

- Enter the dates you hosted the student, specifying the start and end dates clearly.

- If needed, prepare to submit a request for confirmation of hosting dates to CIEE by including the relevant information for verification.

- Review all information for accuracy and completeness to ensure you meet IRS requirements.

- Once everything is filled out correctly, you can save your changes, download the form for your records, print it, or share it with your accountant.

Start completing your IRS CHARITABLE CONTRIBUTION 2009 form online today!

Charitable contributions typically appear as expenses on the income statement of a taxpayer's financial records. Although individuals often report these deductions on their tax returns, businesses might list charitable contributions under operating expenses. Proper bookkeeping for your IRS charitable contribution 2009 ensures clarity and accuracy when filing your taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.