Get Uniform Residential Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uniform Residential Loan Application online

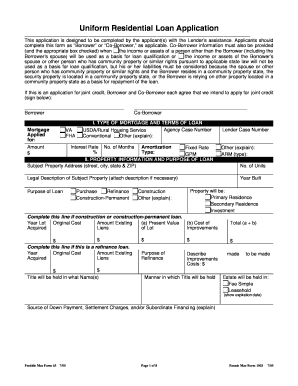

The Uniform Residential Loan Application is a crucial document for individuals seeking to secure a mortgage. This guide provides a clear, step-by-step approach to completing the application online, ensuring that users understand each section and its importance.

Follow the steps to successfully complete your loan application online.

- Press the ‘Get Form’ button to access the Uniform Residential Loan Application and open it in your browser.

- Begin by selecting the type of mortgage you are applying for, such as VA, FHA, USDA, or Conventional, and indicate the loan amount sought.

- Fill in the property information, including the address and legal description, and specify the purpose of the loan—whether it is for purchase, refinance, or construction.

- Complete the borrower information section. Enter the names, Social Security numbers, and contact details for both the borrower and co-borrower (if applicable).

- Provide employment details for both parties, including employer names, addresses, job titles, and income information. Include any additional employment positions if applicable.

- In the income and housing expense section, detail your monthly income sources and any combined housing expenses, including rent, mortgage payments, and insurance.

- Document your assets and liabilities by listing your cash deposits, accounts, debts, and any other financial obligations you currently have.

- Fill out the details of the transaction by specifying purchase prices, estimated closing costs, and any financial transactions relevant to the loan.

- Answer the declaration questions truthfully regarding any outstanding judgments, bankruptcies, or other significant legal matters that may affect the loan.

- Finally, review the acknowledgment and agreement section, ensuring all information is accurate, and provide your electronic signature, along with the co-borrower’s signature if applicable.

- Once you've completed the form, you can save your changes, download a copy for your records, print it, or share it as necessary.

Start your mortgage application process online today!

A uniform mortgage backed security (UMBS) pools loans from the Uniform Residential Loan Application into tradable securities. This process allows investors to fund mortgages, which benefits homebuyers by providing liquidity in the housing market. The UMBS standardizes and simplifies transactions, making it easier for investors to understand the securities backed by residential loans. Knowing about UMBS can enrich your understanding of the mortgage finance system.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.