Loading

Get Credit Card Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Card Application online

Filling out a credit card application online can be a straightforward process if you follow the right steps. This guide will walk you through each section of the Credit Card Application, ensuring you provide all necessary information accurately.

Follow the steps to complete your application smoothly.

- Click the ‘Get Form’ button to access the Credit Card Application form and open it in your viewing or editing interface.

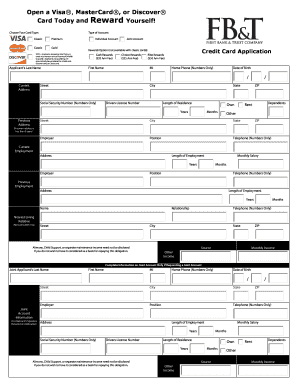

- Begin by selecting your desired card type from the options provided. Choose between Visa®, MasterCard®, or Discover® and select the account type as either individual or joint.

- Fill in your personal information at the top of the form. This includes your first name, middle initial, last name, home phone number, date of birth, current address (including street, city, state, and ZIP code), social security number, and driver's license number.

- Indicate your employment details, including the name of your employer, your position, and the employer's phone number. Also provide your monthly salary, length of employment, and current employment address.

- If applicable, share information about your previous employment, including the previous employer's name, position, and duration of employment.

- Next, disclose any dependents you may have and provide financial details about your monthly income and any additional income sources.

- If applying for a joint account, enter the co-applicant's personal and employment details in the designated section, making sure both parties provide all requested information.

- Review the banking information section. You will need to provide your banking details such as bank name, account types (checking or savings), and account numbers.

- Answer questions regarding bankruptcy history and citizenship status for both applicants.

- Complete the personal information section, including your mother's maiden name for identity verification.

- Acknowledge the product’s terms and conditions by signing and dating the application. If it is a joint application, ensure both applicants sign.

- Once completed, save your changes. You can download, print, or share the form as needed to submit it.

Complete your credit card application online today!

Related links form

The 75 rule for credit cards instructs cardholders to maintain their total balances to 75% or lower of their overall credit limit. Adopting this strategy not only keeps your credit utilization ratio in check but also helps avoid potential fees. This practice reflects responsible credit use, which is favorable when applying for new credit. Keep this rule in mind when you fill out your credit card application to enhance your financial health.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.