Loading

Get Below Is The Sample Statement The Irs Requires To Be Included In The Clients File When The Client

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the below is the sample statement the IRS requires to be included in the client’s file when the client online

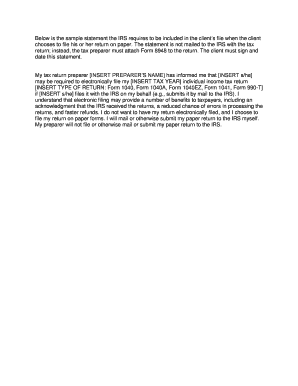

Filing your tax return online can often be streamlined by including specific statements required by the IRS. This guide will walk you through the steps necessary to fill out the sample statement that must be included in your file when you choose to file on paper.

Follow the steps to fill out the statement accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the first section, insert your tax preparer’s name in the designated field labeled [INSERT PREPARER’S NAME]. This identifies who is assisting you with your tax return.

- Next, include the appropriate pronoun for your preparer by replacing [INSERT s/he] with either 'they' if the preparer’s gender is not specified or an appropriate gender pronoun based on preference.

- Make sure to input the tax year for which you are filing in the field labeled [INSERT TAX YEAR]. This is essential for correctly identifying the return you are referencing.

- Specify the type of return by filling in [INSERT TYPE OF RETURN: Form 1040, Form 1040A, Form 1040EZ, Form 1041, Form 990-T]. Selecting the correct form is vital as it dictates the method of filing.

- Acknowledge your understanding of the electronic filing requirements by reviewing the statement. Ensure that the language accurately reflects your choice to file on paper.

- Sign and date the statement at the bottom to validate that you do not wish for your return to be electronically filed and that you will submit your paper return to the IRS yourself.

- After completing the form, you can save your changes, download, print, or share the form as needed.

Complete your documents online today for a smooth filing experience.

The second is the office audit. This type of tax audit refers to the commission requesting an in-person meeting to clarify your tax data.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.