Get Notice Of Unauthorized Ach Debit Activity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notice Of Unauthorized ACH Debit Activity online

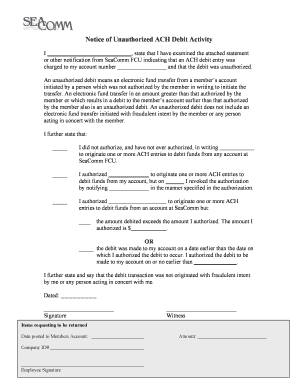

Completing the Notice Of Unauthorized ACH Debit Activity is an essential step for users who need to report an unauthorized electronic fund transfer. This guide will provide clear instructions on how to effectively fill out the form online, ensuring you articulate the necessary details clearly and accurately.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, you will need to state your name clearly. This identifies you as the person reporting the unauthorized ACH debit activity.

- Next, review the statement or notification from SeaComm FCU indicating the unauthorized debit to your account. Confirm the account number is correct before proceeding.

- In the section that defines unauthorized debits, read the criteria carefully. This helps clarify your understanding of what constitutes an unauthorized debit and prepares you to fill out the next parts accurately.

- You will find a series of checkboxes to indicate your situation. Select the appropriate option that matches your experience. For instance, if you never authorized any ACH entries, check the first box.

- If you had previously authorized ACH entries but revoked it, select the second option and provide the relevant details, including the date you revoked authorization.

- In case you authorized a debit but it was different from what was agreed upon, choose the last option. Indicate the amount you authorized, or the date the debit occurred, ensuring accuracy here is crucial.

- Complete the statement confirming that the transaction was not initiated with any fraudulent intent on your part or anyone acting in concert with you.

- Finally, enter the date of the form completion, sign it, and include the witness information if necessary. This step is vital as it validates that the information provided is accurate.

- Once you have filled out all the sections completely, review the form for accuracy, save changes, and then you can download, print, or share the form as needed.

Take the next step to secure your finances by completing and submitting your document online.

An ACH notice from a bank informs you about various transaction activities related to your account. This notice typically includes details about debits and credits, as well as unauthorized or disputed transactions. Understanding these notices allows you to stay informed and protect your finances. Being aware of the implications of a Notice Of Unauthorized ACH Debit Activity helps you know what actions to take.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.