Get Consumer Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Consumer Loan Application online

Completing the Consumer Loan Application online can seem daunting, but with clear guidance, you can navigate the process with ease. This guide provides step-by-step instructions to help you fill out the application accurately and efficiently.

Follow the steps to successfully complete your application.

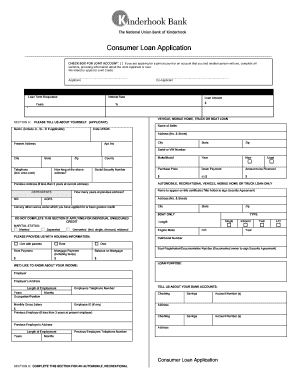

- Click the ‘Get Form’ button to obtain the necessary form and open it in the editor.

- Begin by indicating if you are applying for a joint account. If so, ensure you complete all sections with information about the Joint Applicant. This includes their name and loan-related details.

- Fill in Section A, which requires personal details about the applicant. Provide your full name, date of birth, social security number, and current address.

- For vehicle, mobile home, truck, or boat loans, enter details such as the make and model, year, purchase price, and down payment. Don't forget to include the serial or VIN number.

- Complete housing information, indicating your living situation (rent, own, or live with parents) and the associated costs.

- List your employment details including the employer's name, address, and length of employment, as well as monthly gross salary.

- Provide details about your bank accounts, including checks and savings, along with the account numbers.

- Complete Section C with information about the joint applicant or user if applicable, including their personal and financial details.

- Input your credit references. Be sure to provide information about accounts, unpaid balances, and monthly payments on all referenced credit.

- If any, provide information on other income sources and personal references.

- Fill out the government monitoring section, where you can voluntarily provide details about ethnicity and race.

- Review the certification and signatures section. Both applicants must sign and date the application before submission.

- Finally, save your changes, then download, print, or share the completed form as needed.

Get started on your Consumer Loan Application now by completing the form online.

The maximum debt limit for a consumer proposal in the U.S. is $366,000, excluding your mortgage. This limit ensures that individuals with substantial but manageable debt can find relief. A consumer proposal allows you to consolidate your loans and negotiate with creditors, making it a viable option for handling excessive debt. If you are seeking to manage your debt better, consider exploring our Consumer Loan Application tools available on the uslegalforms platform.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.