Loading

Get Business Loan Customer Identification Program (cip)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BUSINESS LOAN CUSTOMER IDENTIFICATION PROGRAM (CIP) online

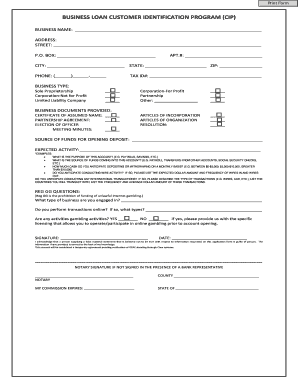

Filling out the Business Loan Customer Identification Program (CIP) form online is an essential step in establishing your business account. This guide offers clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Provide the business name in the designated field to identify your entity clearly.

- Enter the business address in the provided sections for street, P.O. box, apartment number, city, state, and ZIP code.

- Fill in your business phone number, ensuring it is accurate for contact purposes.

- Input your Tax ID number in the corresponding field; this is necessary for identification and verification.

- Select your business type by marking the appropriate checkbox for Sole Proprietorship, Corporation-Not for Profit, Limited Liability Company, Corporation-For Profit, or Partnership. If your business falls under 'Other,' detail the type in the provided space.

- Indicate the associated articles for your business, whether Articles of Incorporation, Articles of Organization, or a Resolution by checking the relevant boxes.

- List the business documents you are providing. Depending on your business structure, this may include a Certificate of Assumed Name, Partnership Agreement, Election of Officer, or Meeting Minutes.

- Describe the source of funds for your opening deposit, providing clear and specific information.

- Detail your expected activity in the account, answering the examples provided about the purpose of the account, anticipated deposits and withdrawals, wire activities, and any international transactions.

- Answer the REG GG questions honestly, specifying the type of business you engage in, any online transaction activities, and details about gambling activities if applicable.

- Sign and date the form in the designated areas to acknowledge the accuracy of the information provided. If a bank representative is not present, include a notary signature and relevant details.

- After completing all sections, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your documents online today to secure your business loan!

CIP refers to the Customer Identification Program, a vital component of the BUSINESS LOAN CUSTOMER IDENTIFICATION PROGRAM (CIP). It involves a series of steps taken to ensure that the identity of a customer is verified before engaging in business transactions. Essentially, the meaning of CIP is about creating a secure, trustworthy business environment while complying with legal standards.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.