Loading

Get 1996 Form 3903f. Foreign Moving Expenses

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1996 Form 3903F. Foreign Moving Expenses online

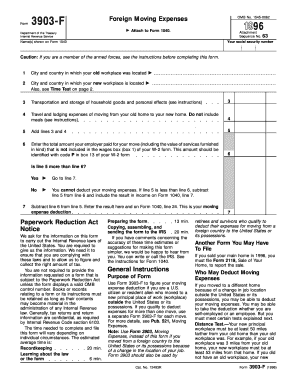

Filling out Form 3903F can seem daunting, but this guide will walk you through each section step by step. This form is used for claiming deductions for foreign moving expenses and is essential for those relocating due to a job change outside the United States.

Follow the steps to successfully complete your form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section 1, where you will enter the city and country of your old workplace in the designated field. This is important for establishing your previous work location.

- In Section 2, input the city and country of your new workplace. This information helps to clarify where your new job is located.

- Proceed to Section 3. Here, you will detail the transportation and storage costs for your household goods and personal effects. Ensure you provide your actual expenses.

- In Section 4, calculate and enter the travel and lodging expenses incurred while moving from your old home to your new home. Note that meals should not be included.

- Sum the amounts from Sections 3 and 4, and enter the total in Section 5.

- In Section 6, report the total amount your employer paid for your move that is not included in your W-2 wages. Be sure to identify this amount with code P on your W-2.

- Section 7 requires you to determine if the total of Section 5 is more than Section 6. If it is, check 'Yes' and proceed. If not, you cannot deduct your moving expenses.

- If Section 5 exceeds Section 6, subtract line 6 from line 5 and enter the result as your moving expense deduction on your Form 1040, line 24.

- Once all sections are completed with accurate information, you can save your changes, and choose to download, print, or share the completed form online.

Ensure your moving expenses are documented accurately by filling out your forms online today.

Form 3903 can be completed for the amount of moving expenses paid by the taxpayer. If a moving expense deduction is computed, it will be reported on Schedule 1 (Form 1040) Additional Income and Adjustments to Income, on Line 14.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.