Loading

Get Commerce Advantage Business Credit Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Commerce Advantage Business Credit Application online

Filling out the Commerce Advantage Business Credit Application online can streamline the process of securing financing for your business needs. This guide will provide detailed, step-by-step instructions to ensure that you complete the application accurately and efficiently.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to access the Commerce Advantage Business Credit Application and open it in your preferred online document editor.

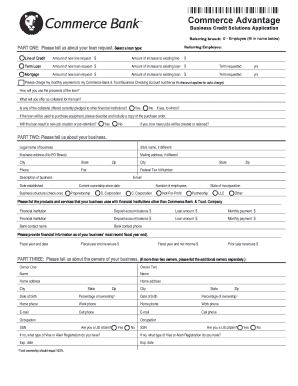

- Begin with Part One, where you will specify your loan request. Select the loan type you are applying for, such as a line of credit, term loan, or mortgage. Fill in the requested loan amounts and terms as applicable.

- Indicate how you plan to use the loan proceeds and what collateral you will provide. If any of the collateral is pledged to other financial institutions, specify accordingly.

- In Part Two, fill in the details about your business. Enter the legal name, mailing address, and federal tax ID number. Ensure you provide a comprehensive description of your business along with the date established.

- List the business structure, such as corporation, partnership, or LLC, and the number of employees. Record any financial relationships with other institutions, detailing deposit account balances and loan amounts.

- Proceed to Part Three, where you will need to provide information about the owners of the business. Include their names, addresses, dates of birth, and ownership percentages. Indicate if each owner is a U.S. citizen and provide relevant financial information.

- In Part Four, answer general questions related to claims, lawsuits, or tax obligations affecting you or your business. Provide explanations if you answer ‘yes’ to any of the inquiries.

- Review all provided information to ensure accuracy and completeness. After confirming that all required fields are filled out, proceed to the submission section.

- Finally, click the 'Submit' button to send your application for processing. Alternatively, you may also save changes, download, or print the completed form for your records.

Get started with your Commerce Advantage Business Credit Application today and increase your chances of securing the funding you need.

Getting a business credit card can be challenging, but it largely depends on your creditworthiness. Applicants with a decent credit score usually have better chances. Using the Commerce Advantage Business Credit Application streamlines the process, helping you find options that match your financial profile.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.