Loading

Get Credit Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CREDIT APPLICATION online

Completing a credit application online can seem daunting, but following this guide will make the process straightforward and efficient. This guide provides step-by-step instructions to help you fill out the CREDIT APPLICATION with confidence.

Follow the steps to complete your application smoothly.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

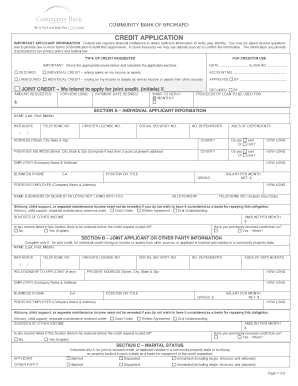

- Begin by checking the type of credit requested. You can choose options like secured, unsecured, or joint credit based on your situation.

- Fill in the date and class number at the top of the form as well as the amount requested and desired payment date.

- In Section A, provide your individual applicant information, including your full name, birthdate, telephone number, driver's license number, social security number, number of dependents, and their ages. Ensure all details are accurate.

- Complete your current and previous addresses with the necessary details, especially if you have resided at your current address for less than three years.

- Fill in your employment details, including your company name, address, position, and salary information. Include your previous employer if applicable.

- Specify any alimony or child support income if you wish to have it considered, and indicate if any income might reduce before your credit request is fulfilled.

- Section B is for joint applicant information—complete this only if you are applying jointly or relying on someone else's income.

- In Section C, indicate your marital status, as this is necessary for joint or secured credit.

- Section D requires you to list your assets and debts. Clearly categorize your assets, providing values and account numbers where necessary.

- Mark if you have any outstanding debts, ensuring to include details about monthly payments and account numbers.

- Complete Section E if your credit request is to be secured, providing a description of the property that will be used as security.

- Sign and date the application to certify the accuracy of the information provided.

- Finally, ensure all changes are saved. You can download, print, or share the filled application as required.

Complete your credit application online today and take the first step towards your financial goals.

To submit a credit application, ensure you have all necessary personal and financial information at hand. You can complete the application online or in person at a lender's office. After entering your details, double-check for accuracy before submitting the application, allowing the lender to process your request efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.