Loading

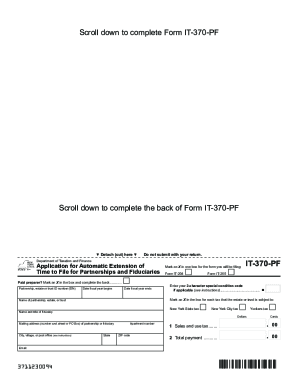

Get Ny Dtf It-370-pf 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-370-PF online

The NY DTF IT-370-PF is an essential form for partnerships and fiduciaries seeking an automatic extension of time to file. This guide provides clear, step-by-step instructions for completing the form online, ensuring users understand each section.

Follow the steps to fill out the NY DTF IT-370-PF online effectively.

- Click ‘Get Form’ button to access the form electronically and open it in the designated interface.

- Fill in the partnership, estate, or trust identification number (EIN) in the designated field. Ensure that the number is accurate to avoid issues with your submission.

- Enter the date the fiscal year begins and the date the fiscal year ends in the respective fields, ensuring the format is appropriate for your submission year.

- Select one box to indicate the form you will be filing among the options provided: Form IT-204, IT-370-PF, or Form IT-205.

- If applicable, enter your special condition code in the designated field, referencing the accompanying instructions as necessary.

- Indicate each tax the estate or trust is subject to by marking an X in the appropriate boxes for New York State tax, New York City tax, and Yonkers tax.

- Provide the name of the partnership, estate, or trust clearly, as well as the name and title of the fiduciary responsible.

- Complete the mailing address for the partnership or fiduciary, including the street address, city or village, state, ZIP code, and apartment number if applicable.

- Input your email address in the required field to ensure communication regarding your submission.

- On the back of the form, review the payment options, ensuring any balance due is accurately calculated. Payment must be made via check or money order payable to New York State Income Tax.

- If utilizing a paid preparer, make sure they complete their section on the form, including signing it and providing their NYTPRIN and PTIN if applicable. Entering exemption codes where necessary is crucial for compliance.

- After reviewing all entries for accuracy, you can save changes, download a copy for your records, print the form, or share it as needed.

Start completing your NY DTF IT-370-PF online today to ensure timely filing and compliance.

If you don't file a Federal consolidated return and you owe Tennessee tax, you can request a state extension using either Tennessee Form FAE-173 or Federal Form 7004. Tennessee Extension Payment Requirement: An extension of time to file is not an extension of time to pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.