Get L-006a Explanation List Partnership.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the L-006a Explanation List Partnership.doc online

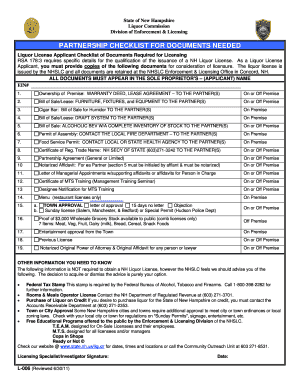

The L-006a Explanation List Partnership.doc is a critical document for partnership-based liquor license applicants in New Hampshire. This guide provides a step-by-step approach to assist users in accurately completing the form online, ensuring a smooth application process.

Follow the steps to fill out the L-006a Explanation List Partnership.doc online.

- Click the ‘Get Form’ button to obtain the L-006a Explanation List Partnership.doc and open it in your preferred document editing tool.

- Begin filling out the applicant's details at the top of the form. Ensure that all partners' names are included as this document pertains specifically to partnerships. Double-check spelling and accuracy.

- In the section titled 'Ownership of Premise,' provide the necessary documentation, such as a warranty deed or lease agreement, confirming that the premises are under the names of the partners.

- Next, complete the 'Bill of Sale or Lease for Furniture, Fixtures, and Equipment' section, ensuring that the documents confirm ownership or rental is in the partners' names.

- Include information regarding any cigar bars by providing a bill of sale for the humidor, again in the names of the partners.

- If applicable, submit copies of the necessary permits such as the permit of assembly from the local fire department showing the seating capacity.

- Complete the 'Food Certification Permit' section by securing the health certificate from the local health agency.

- For itemization of products, document any previous licensed premises details and attach relevant bills of sale or inventory lists as required.

- Once all sections are filled out and relevant documents attached, review the form for accuracy and completeness.

- Finally, save your changes, and choose whether to download, print, or share the completed form as needed.

Complete the L-006a Explanation List Partnership.doc online today to ensure your liquor license application is submitted accurately and promptly.

Booking partnership income involves accurately recording profits earned by the partnership and distributing them according to the partnership agreement. Each partner's share of income must be documented properly for tax reporting purposes. You can find insights on this process in the L-006a Explanation List Partnership.doc, which details financial management within a partnership.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.