Loading

Get House Docket, No. 1700

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HOUSE DOCKET, NO. 1700 online

The HOUSE DOCKET, NO. 1700 is an important document for petitioning the adoption of legislative bills in Massachusetts. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that all users, regardless of their legal experience, can navigate the process with ease.

Follow the steps to fill out the HOUSE DOCKET, NO. 1700 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

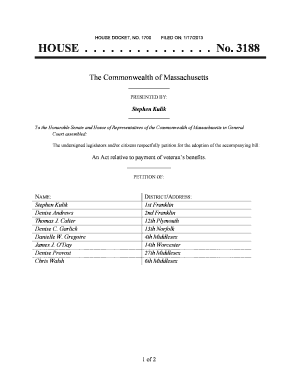

- Begin filling out the petition by entering the name of the legislation, which in this case includes 'An Act relative to payment of veteran’s benefits.' Make sure to include the date of filing, which is 1/17/2013.

- List the names of the legislators or individuals petitioning. Ensure that each name is clearly indicated, starting with the primary sponsor, Stephen Kulik, followed by the others: Denise Andrews, Thomas J. Calter, Denise C. Garlick, Danielle W. Gregoire, James J. O'Day, Denise Provost, Chris Walsh.

- Fill in the corresponding district addresses for each petitioner. For example, specify 1st Franklin for Stephen Kulik, 2nd Franklin for Denise Andrews, and continue the pattern for each name.

- In the subsequent section, provide the legislative details clearly. This includes describing the proposed amendment to Chapter 115 of the General Laws, ensuring you capture all sections accurately as stated in the document.

- Review all entered information for accuracy and completeness. Pay special attention to legal language and any required details relevant to veterans’ benefits.

- Once you have filled out the form, you can save your changes, download the completed document, print it for physical submission, or share it electronically as required.

Complete your HOUSE DOCKET, NO. 1700 online today to facilitate the legislative process.

Individuals who earn income from business or self-employment are required to file BIR form 1701, in accordance with HOUSE DOCKET, NO. 1700. This includes sole proprietors, freelancers, and professionals who earn their income independently. Ensuring you file this form correctly is vital for staying compliant with tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.