Loading

Get 504e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 504E online

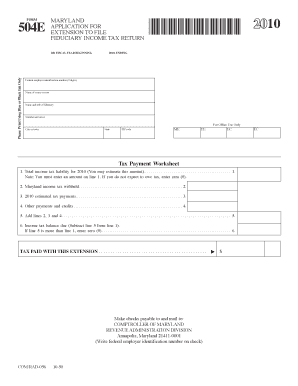

Form 504E is the Maryland application for an extension to file fiduciary income tax returns. This guide provides clear, step-by-step instructions for completing this form online, ensuring compliance while navigating the filing process.

Follow the steps to accurately complete the 504E form online.

- Click ‘Get Form’ button to obtain the 504E and open it in the editor.

- Begin by filling out the federal employer identification number, which consists of nine digits. This identifies your estate or trust for tax purposes.

- Enter the name of the estate or trust as it appears on official documents. This should match the name associated with your employer identification number.

- Provide the name and title of the fiduciary responsible for managing the estate or trust. This person should be authorized to make decisions regarding the tax return.

- Complete the address fields: number and street, city or town, state, and ZIP code for the fiduciary.

- On the tax payment worksheet, enter your total income tax liability for 2010 on line 1. If you do not expect to owe any tax, enter zero (0).

- Input the amount of Maryland income tax withheld on line 2; this should reflect any prepayments made.

- Indicate your 2010 estimated tax payments on line 3, providing a record of any advance payments made towards your tax liability.

- On line 4, report any other payments or credits applicable to your estate or trust.

- Add the amounts from lines 2, 3, and 4 together on line 5 to determine total credits.

- Calculate the income tax balance due on line 6 by subtracting line 5 from line 1. If the total credits exceed the liability, enter zero (0) instead.

- Fill in the section for tax paid with this extension, if applicable.

- Finally, review all entered information for accuracy. Save your changes, then download, print, or share the completed form as needed before submitting it.

Complete your 504E online to ensure timely and accurate filing.

Filling an e-file requires attention to detail and accuracy. Begin with the correct form on the 504E platform, input all necessary information clearly, and verify each section as you go. By following the platform’s guidance, you make sure your e-file submission is both accurate and complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.