Loading

Get 500up

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 500UP online

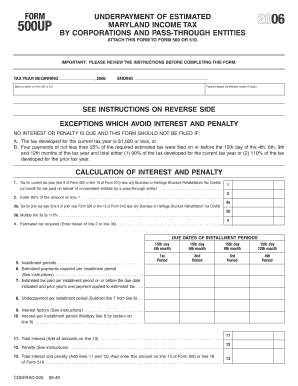

Filling out the 500UP form is essential for corporations and pass-through entities to calculate potential interest and penalties related to underpayment of estimated Maryland income tax. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the 500UP form.

- Press the ‘Get Form’ button to download the 500UP form and open it in your preferred online editor.

- Enter the tax year at the top of the form, specifying the beginning and ending dates clearly.

- Input the name as it appears on Form 500 or 510 in the designated area. Additionally, enter the federal employer identification number; if you have not secured one, write 'APPLIED FOR' followed by the application date.

- Fill out the calculation of interest and penalties by completing lines 1 through 13 methodically as directed. Make sure to subtract any applicable credits from your tax amount on line 1.

- Follow specific instructions for estimating taxes for each installment period, entering the required amounts on line 6 based on the determined tax for the current year.

- Record estimated payments made by the due dates on line 7, categorizing them by installment periods accurately.

- Calculate any penalties or interest as detailed in the form instructions. Use the provided interest factors for calendar year corporations to find the correct rates for line 9.

- Consolidate and check your totals. Ensure that the total interest and penalties are calculated and recorded on line 13, ready for submission.

- Once completed, save your changes, then download, print, or share the filled-out form as needed.

Complete your tax documents online now to ensure timely and accurate filings.

Filing GSTR 1 offline can be streamlined using 500UP. First, download the GST offline utility tool from the official GST website. Then, prepare your GSTR 1 details offline, upload them via the utility, and finally submit your return through the offline structure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.