Loading

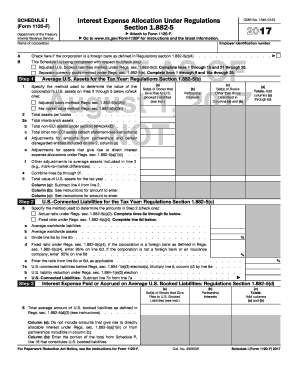

Get 2017 Form 1120-f (schedule I). Interest Expense Allocation Under Regulations Section 1.882-5

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2017 Form 1120-F (Schedule I). Interest Expense Allocation Under Regulations Section 1.882-5 online

This guide provides a comprehensive approach to completing the 2017 Form 1120-F (Schedule I). It is designed to assist users in accurately reporting interest expense allocations as per the IRS regulations.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Determine which method you will use for interest expense allocation: the adjusted U.S. booked liabilities method or the separate currency pools method. Check the appropriate box.

- For Step 1, calculate your average U.S. assets for the tax year. Specify the method used to determine the value of U.S. assets and fill in lines 2 through 5 with the corresponding data.

- In Step 2, determine your U.S.-connected liabilities for the tax year. Specify your calculation method (actual ratio or fixed ratio) and complete lines 6a through 6d.

- Proceed to Step 3 where you will report the interest expense paid or accrued. Complete lines 8 and 9, ensuring not to include amounts that give rise to directly allocable interest in the specified columns.

- If applicable, complete lines 10 through 14 for the adjusted U.S. booked liabilities method, focusing on interest related to U.S. dollar liabilities.

- Complete lines 15 through 20 for the separate currency pools method if applicable. Enter the total interest expense allocations in line 21.

- Summarize your total interest expense deductions in lines 22 through 25, ensuring you follow the guidance in the instructions carefully.

- Once completed, save your changes, then download, print, or share the form as necessary.

Take action and complete your forms online for accuracy and compliance.

The amount of interest expense from Schedule I, line 24g is reportable on Form 1120-F, Section III, Part II, line 7b. The amount of the allocation under Regulations section 1.882-5 reportable on Schedule I, line 23 is reportable on Form 1120-F, Section III, Part II, line 7c.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.