Loading

Get Form 502d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 502D online

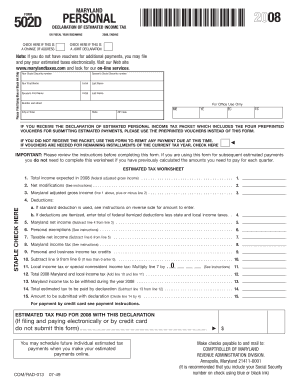

Filling out the FORM 502D, the Declaration of Estimated Income Tax, is an essential part of managing your tax obligations in Maryland. This guide provides you with clear step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to complete the FORM 502D online easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Social Security number and your spouse’s Social Security number if applicable. Follow with your first name, initial, and last name, along with your spouse’s corresponding information if this is a joint declaration.

- In the address section, fill in your number and street, city or town, state, and ZIP code. Ensure accuracy to avoid delays in processing.

- Review the instructions provided on the form regarding estimated tax payments and check the appropriate boxes if there is a change of address or if you are filing jointly.

- Use the estimated tax worksheet provided. Start with your total expected income for 2008 in line 1, followed by making any necessary modifications in line 2.

- Continue to fill in your Maryland adjusted gross income in line 3, applying any deductions in line 4 based on whether you choose standard or itemized deductions.

- Calculate your personal exemptions in line 6 according to the instructions and enter any taxable net income in line 7.

- Complete lines 8 through 14 based on the tax calculation details outlined in the instructions, including any credits, local taxes, and the total amount due.

- Finally, ensure that all sections are filled out completely and accurately. You can save your changes, download the completed form, print it, or share it as required for your records.

Start completing your documents online to manage your tax responsibilities effectively.

To obtain a BIR form, visit the Board of Revenue or the relevant tax authority in your area. Many forms are available online for download, making them easy to access. If you need specific forms such as the FORM 502D for tax exemptions, using US Legal Forms can streamline the process, offering you the appropriate forms readily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.