Loading

Get 500d Corporation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 500D CORPORATION online

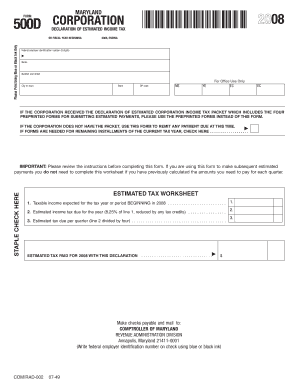

Filling out the 500D CORPORATION form is essential for corporations declaring estimated income tax. This guide provides step-by-step instructions to help users navigate the online form accurately and efficiently.

Follow the steps to complete the online form successfully.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Enter the federal employer identification number (9 digits) in the designated field.

- Provide the name of the corporation as specified in the Articles of Incorporation, followed by any applicable 'Trading As' name.

- Complete the address section by entering the street, city or town, state, and ZIP code.

- Indicate the fiscal year by entering the beginning and ending dates for the tax year.

- Review the instructions and estimated tax worksheet carefully to determine your taxable income expectations for the tax year.

- Calculate the estimated income tax due based on 8.25% of the expected taxable income, taking any tax credits into account.

- Divide the total estimated tax due by four to determine the estimated tax per quarter.

- Enter the amount of estimated tax paid with this declaration in the designated space.

- Remember to staple your check here if you are remitting payment via check.

- Complete this form by following all instructions and ensuring accuracy before submission.

- Save your changes, and once completed, download, print, or share your form as necessary.

Complete your 500D CORPORATION form online today to ensure timely tax payments.

Filing a UAE corporate tax return involves registering with the relevant tax authorities and preparing the required documentation. You'll need to keep accurate financial records throughout the year. The 500D CORPORATION platform has comprehensive tools that make this process more manageable, guiding you from start to finish. Once all documentation is prepared, submit it online to avoid any delays.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.