Loading

Get Form It-59 Tax Forgiveness For Victims Of The ... - Tax.ny.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

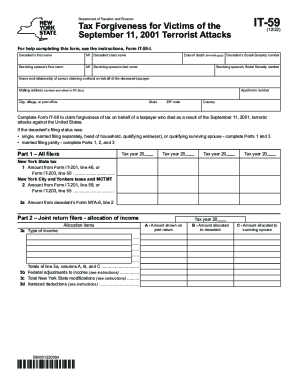

How to fill out the Form IT-59 Tax Forgiveness For Victims Of The September 11, 2001 Terrorist Attacks online

Filling out the Form IT-59 is an important step for individuals seeking tax forgiveness for victims of the September 11, 2001, terrorist attacks. This guide will provide clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Form IT-59 online.

- Press the ‘Get Form’ button to access the form and open it in the provided editor.

- Enter the decedent’s first name, middle initial (MI), and last name in the designated fields.

- Provide the surviving spouse’s first name, middle initial (MI), and last name. Include the date of death in the format mm-dd-yyyy.

- Fill out the Social Security numbers for both the decedent and the surviving spouse in the appropriate fields.

- Indicate the name and relationship of the person claiming a refund on behalf of the deceased taxpayer.

- Enter the complete mailing address, including apartment number, street address, city, state, ZIP code, and country.

- Complete Part 1 for all filers by entering tax year(s) and corresponding amounts from the relevant tax forms (IT-201 or IT-203).

- If filing a joint return, complete Part 2 by allocating the income amounts between the decedent and surviving spouse across specified columns.

- Proceed to Part 3 and fill out the survivor’s affidavit, ensuring to select the appropriate relationship to the decedent.

- Sign and date the form as the claimant, or have your preparer complete their information if applicable.

- After filling out the form, review all entries for accuracy and completeness before final steps.

- Save your changes, and utilize the options to download, print, or share the completed form as needed.

Complete your Form IT-59 online today to ensure timely processing of your tax forgiveness request.

The Offer in Compromise program allows qualifying, financially distressed taxpayers the opportunity to put overwhelming tax liabilities behind them by paying a reasonable portion of their tax debt. We can consider offers in compromise from: individuals and businesses that are insolvent or discharged in bankruptcy, and.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.